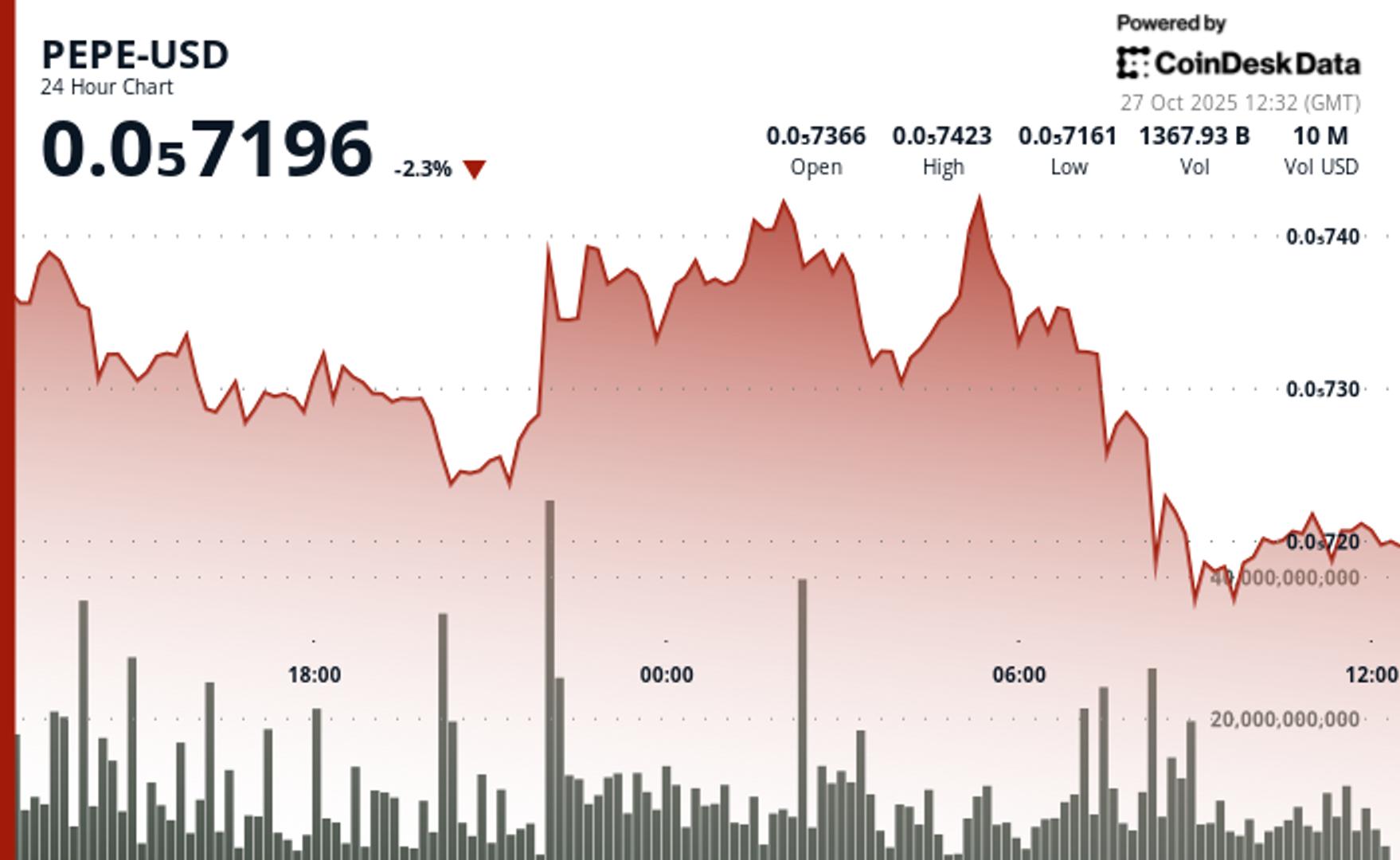

PEPE Drops Nearly 2% as Memecoins Struggle, Late-Session Bounce Hints at Buyer Support

NegativeCryptocurrency

PEPE, a popular memecoin, has seen a nearly 2% drop as the overall memecoin market struggles. This decline reflects broader challenges in the cryptocurrency space, but a late-session bounce suggests that there may still be buyer support. Understanding these fluctuations is crucial for investors, as they indicate market sentiment and potential recovery opportunities.

— Curated by the World Pulse Now AI Editorial System