XRP ETF From REX Shares Soars Past $100M, Signaling Robust Institutional Interest

PositiveCryptocurrency

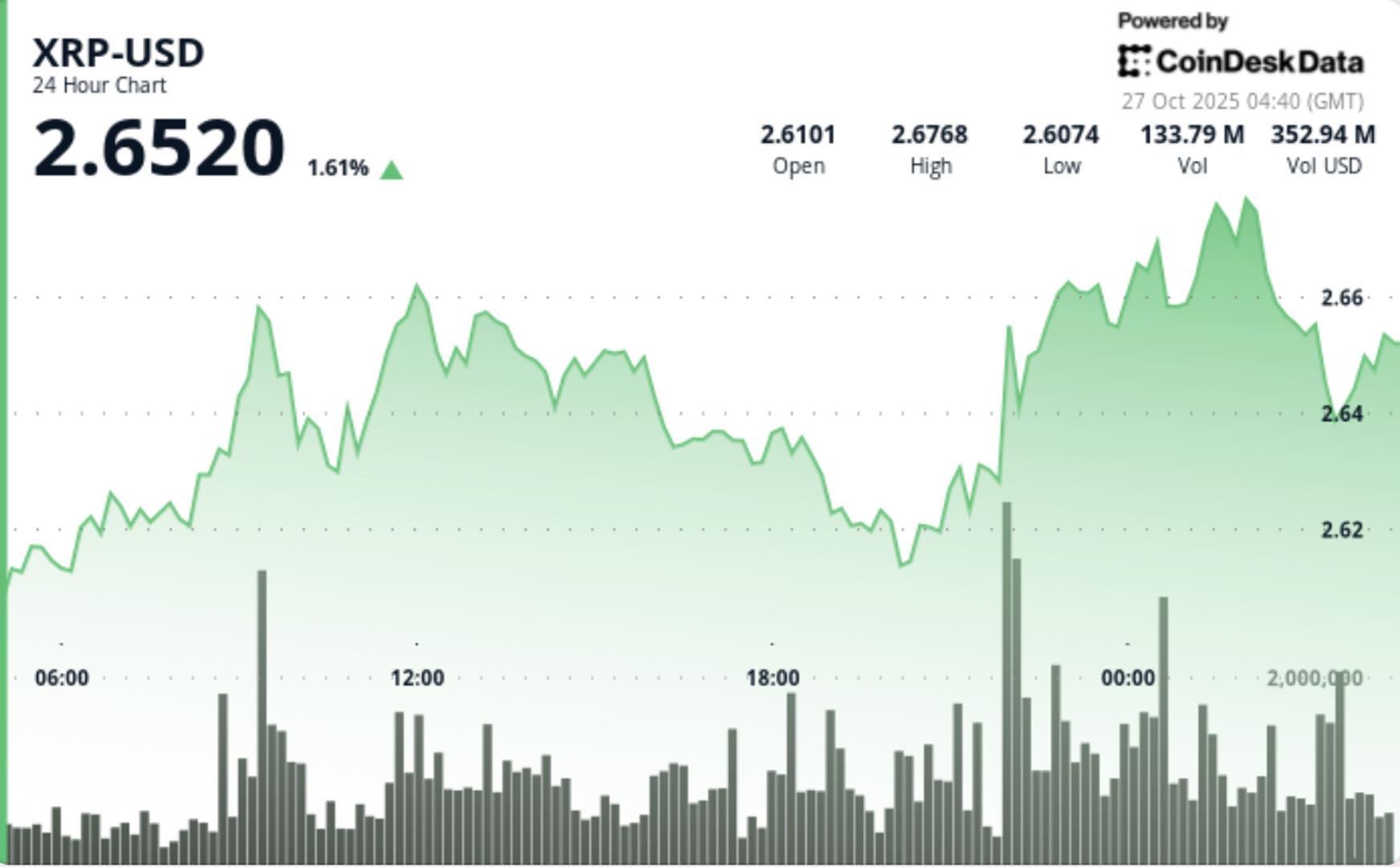

The XRP ETF from REX Shares has surpassed $100 million in assets, highlighting a significant surge in institutional interest in cryptocurrency investments. This milestone not only reflects growing confidence in the digital asset market but also indicates that more traditional investors are looking to diversify their portfolios with crypto assets. As institutional participation increases, it could lead to greater stability and legitimacy for cryptocurrencies, making this development a noteworthy moment for the industry.

— Curated by the World Pulse Now AI Editorial System