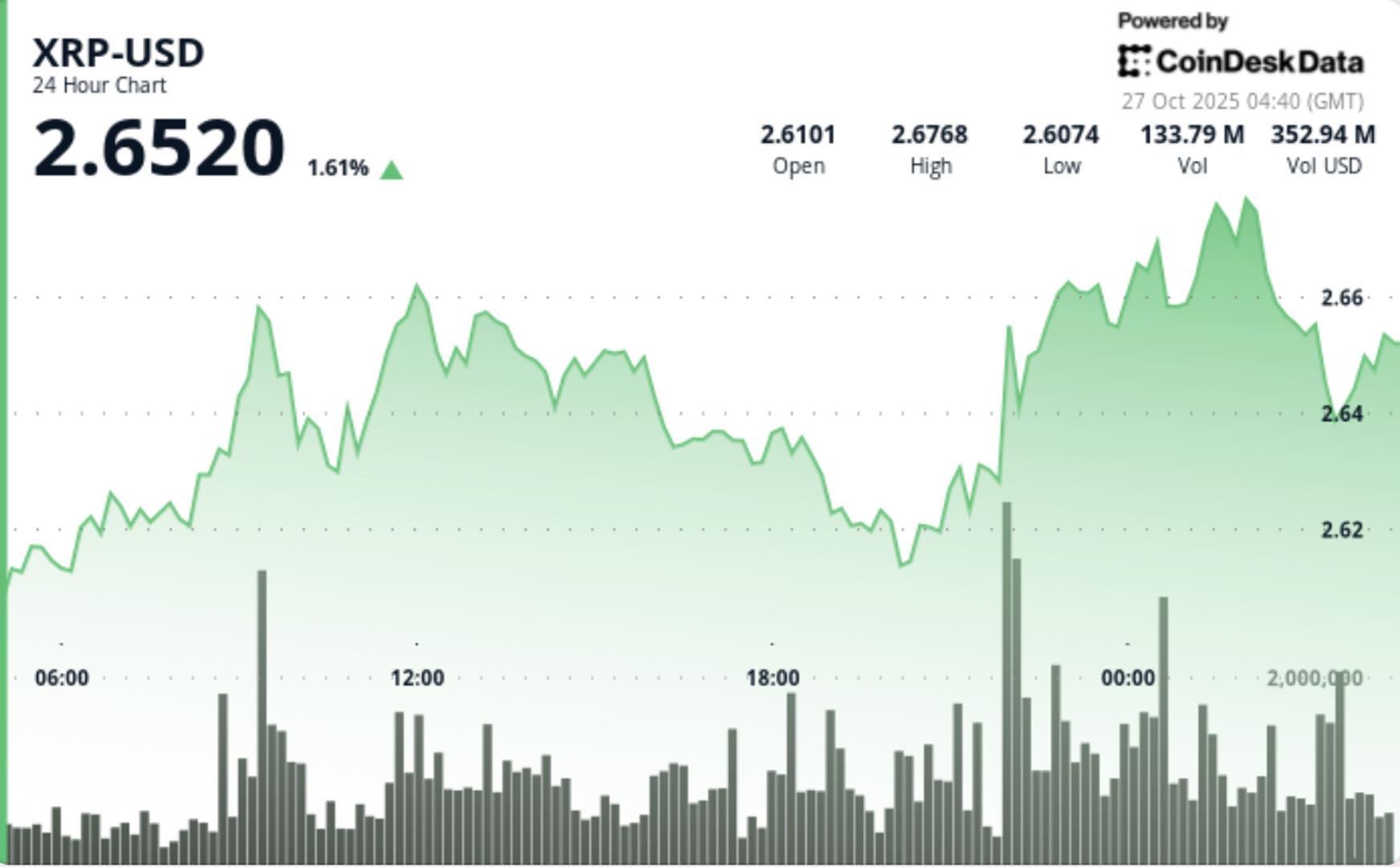

Indian Judge Halts WazirX’s XRP Reallocation Plan Linked to 2024 Hack

NeutralCryptocurrency

An Indian judge has put a stop to WazirX's plan to reallocate XRP tokens that were linked to a hack that occurred in 2024. This decision is significant as it highlights the ongoing legal challenges faced by cryptocurrency exchanges in India, especially in the wake of security breaches. The ruling may impact how exchanges manage their assets and respond to cyber threats, emphasizing the need for robust security measures in the rapidly evolving crypto landscape.

— Curated by the World Pulse Now AI Editorial System