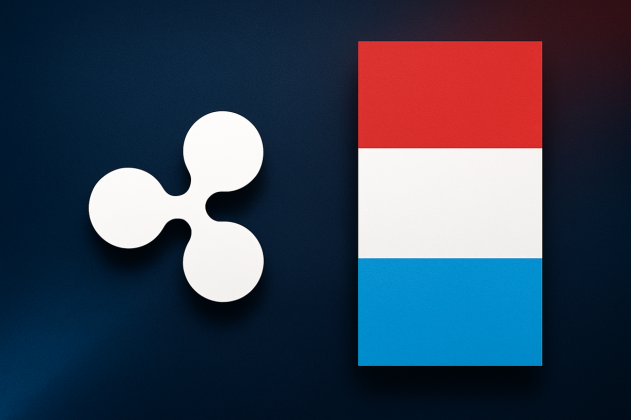

Ripple Execs Meet Luxembourg’s Finance Minister: A Deal In The Making?

PositiveCryptocurrency

Ripple's executives recently met with Luxembourg's Finance Minister Gilles Roth to discuss obtaining a license that would allow the company to offer regulated digital-asset services across the European Union. This meeting is significant as it could pave the way for Ripple to expand its operations in Europe, enhancing its position in the fintech landscape and potentially benefiting the broader digital asset market.

— Curated by the World Pulse Now AI Editorial System