As stagflation looms, experts advise: own assets or risk being left behind

PositiveCryptocurrency

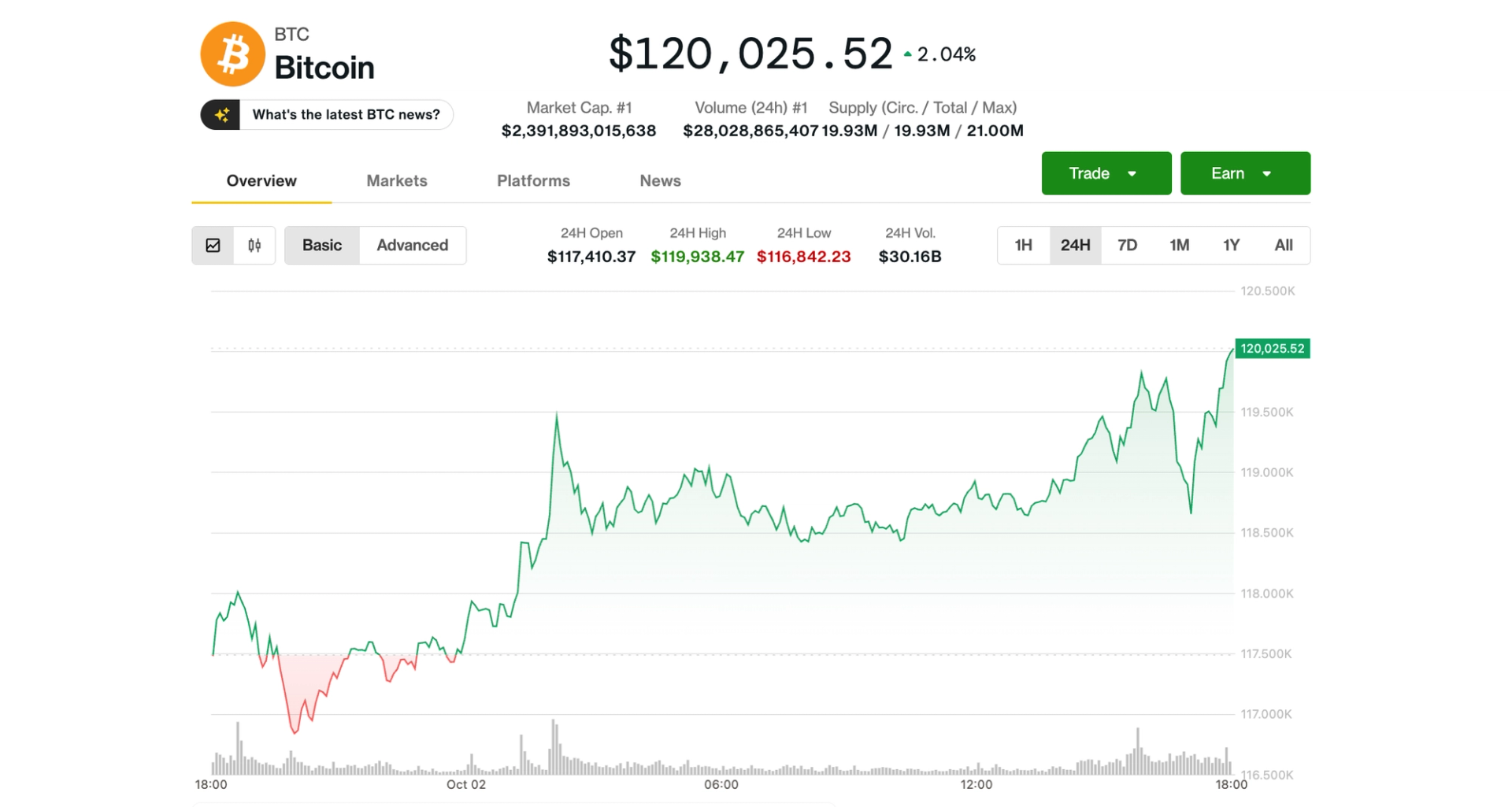

As stagflation becomes a pressing concern, experts emphasize the importance of owning tangible assets to safeguard financial stability. With the Federal Reserve cutting rates amidst rising inflation, individuals are urged to adapt to this new economic landscape. This advice is crucial as it highlights the need for proactive financial strategies to avoid being left behind in uncertain times.

— Curated by the World Pulse Now AI Editorial System