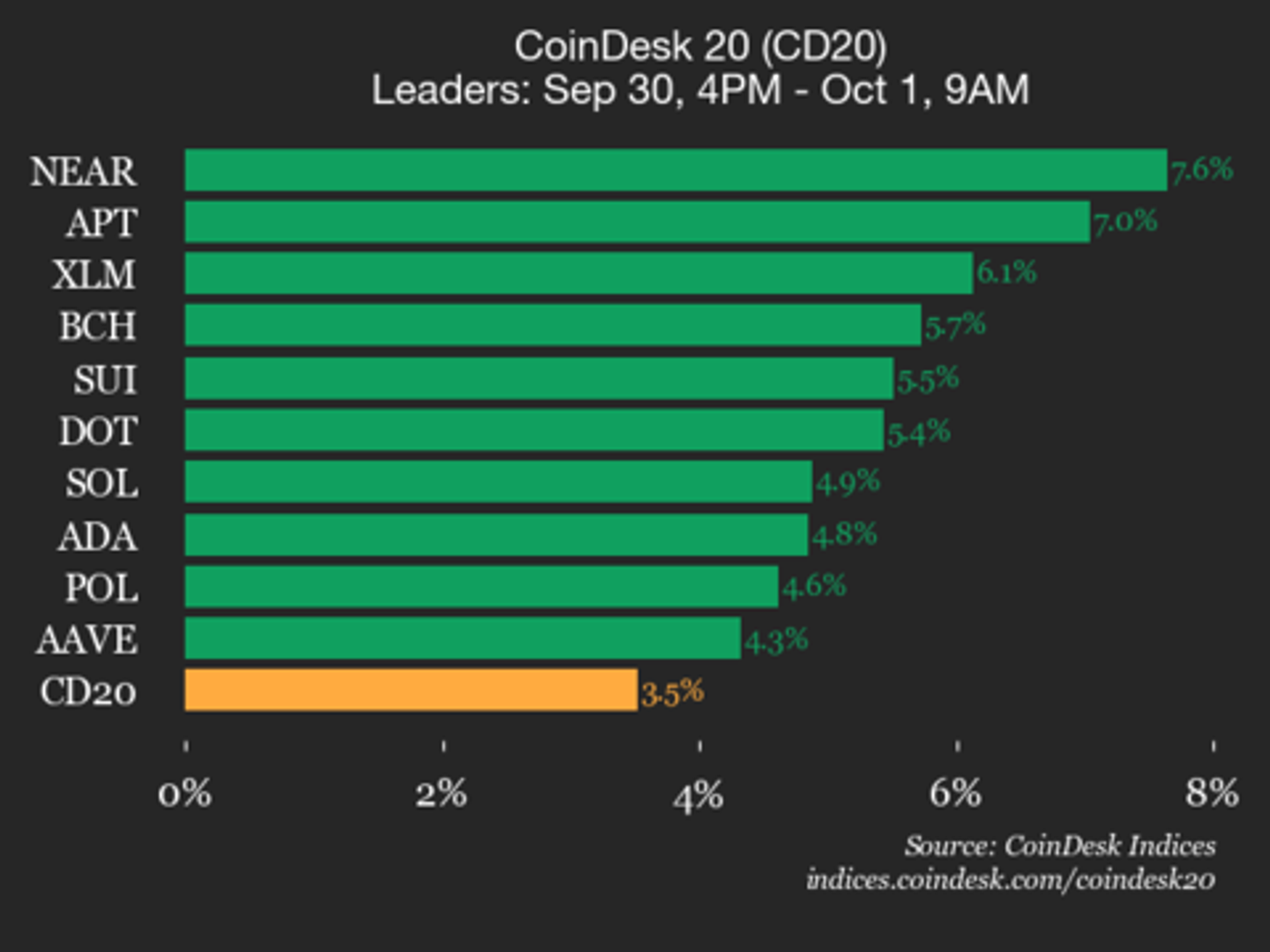

CoinDesk 20 Performance Update: Index Jumps 3.5% as All Constituents Trade Higher

PositiveCryptocurrency

The CoinDesk 20 index has seen a notable increase of 3.5%, with all its constituents trading higher. This performance update is significant as it reflects a positive trend in the cryptocurrency market, indicating growing investor confidence and potential for future gains. Such movements can influence market sentiment and attract more participants to the crypto space.

— Curated by the World Pulse Now AI Editorial System