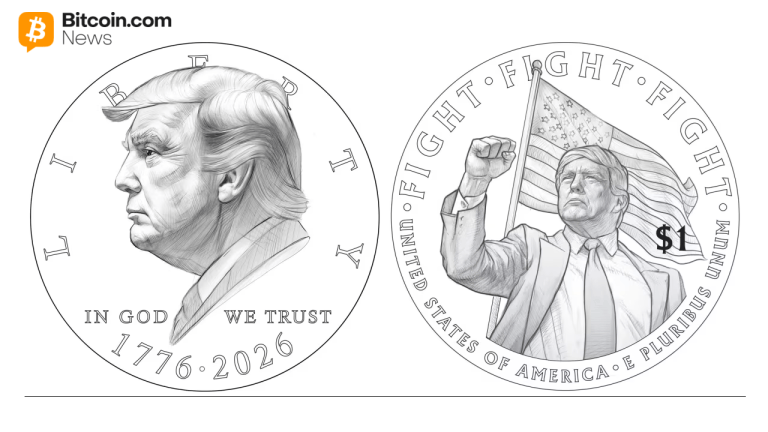

US Treasury May Mint a Trump One-Dollar Coin

NeutralCryptocurrency

The US Treasury is considering minting a one-dollar coin featuring former President Donald Trump. This proposal has sparked discussions about the significance of commemorative coins and their role in American culture. While some view it as a way to honor a controversial figure, others question the appropriateness of such a move. The decision could reflect broader sentiments about Trump's legacy and the ongoing debates surrounding his presidency.

— Curated by the World Pulse Now AI Editorial System