US Regulators Unite to Ignite Unstoppable Financial Innovation Wave

PositiveCryptocurrency

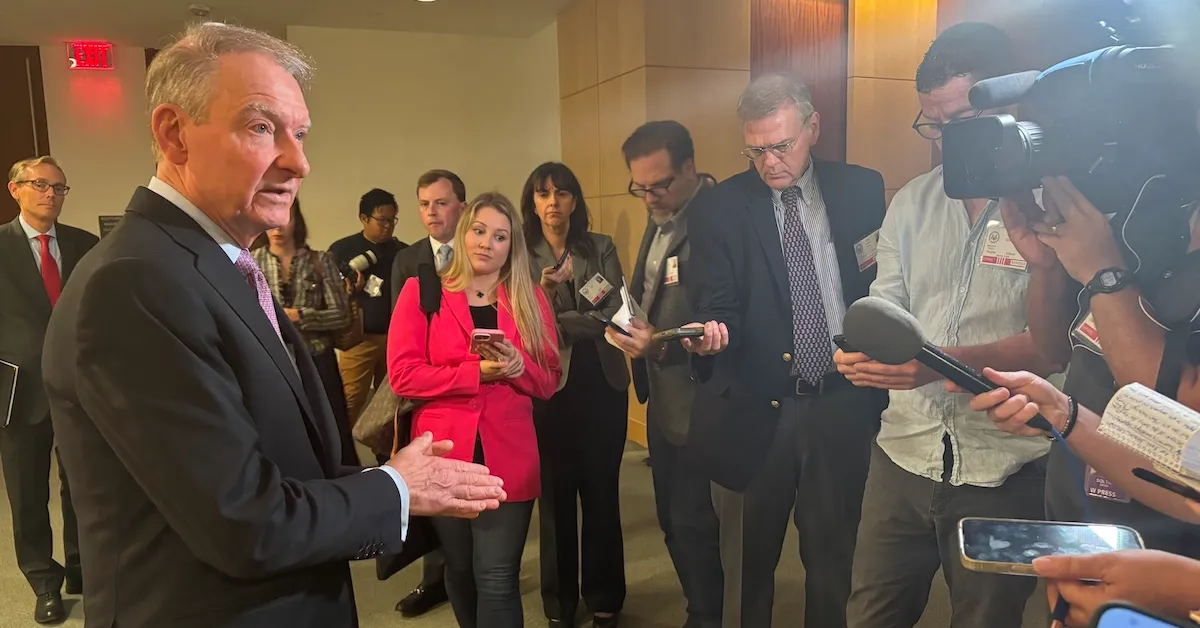

US regulators are coming together to foster a new wave of financial innovation, signaling a positive shift in the regulatory landscape. This collaboration between the SEC and CFTC aims to create a more supportive environment for emerging technologies and financial products, which could lead to significant advancements in the industry. By uniting their efforts, these agencies are not only enhancing investor protection but also encouraging growth and competition in the financial sector, making it an exciting time for businesses and consumers alike.

— Curated by the World Pulse Now AI Editorial System