US regulators dismiss SEC-CFTC merger rumors, move to dispel crypto ‘FUD’

NeutralCryptocurrency

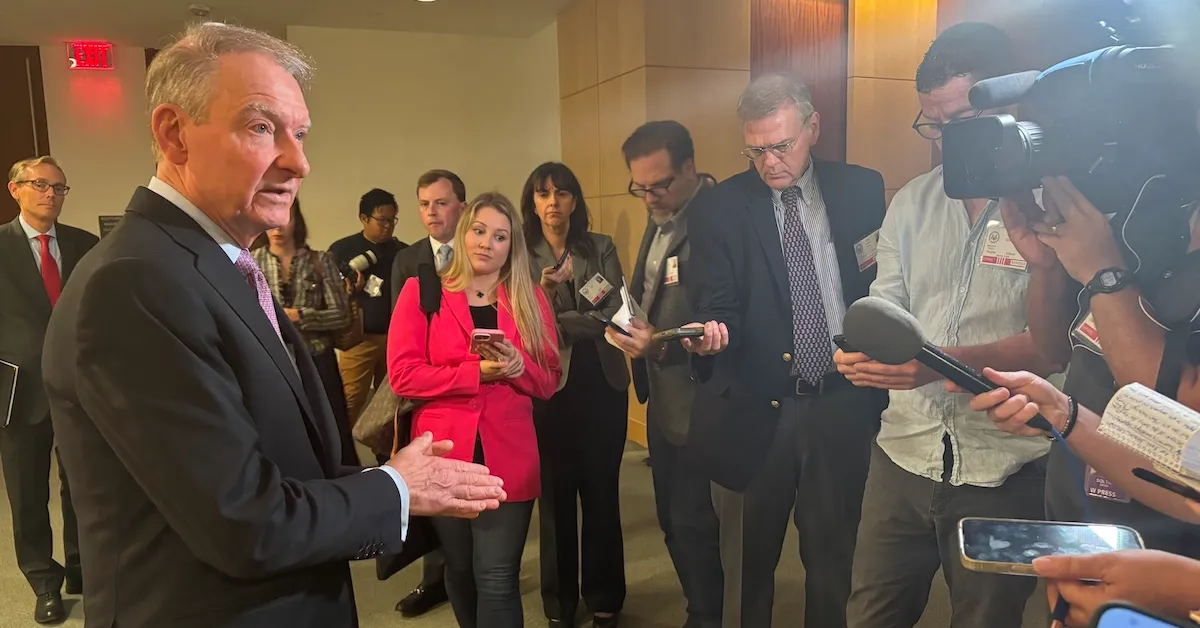

US regulators have dismissed rumors about a potential merger between the SEC and CFTC, aiming to alleviate fears surrounding the cryptocurrency market. Caroline Pham, the acting chair of the CFTC, highlighted the agency's enforcement actions during a recent roundtable discussion. This clarification is significant as it helps to stabilize the crypto landscape by addressing misinformation and reinforcing the regulatory framework, which is crucial for investor confidence.

— Curated by the World Pulse Now AI Editorial System