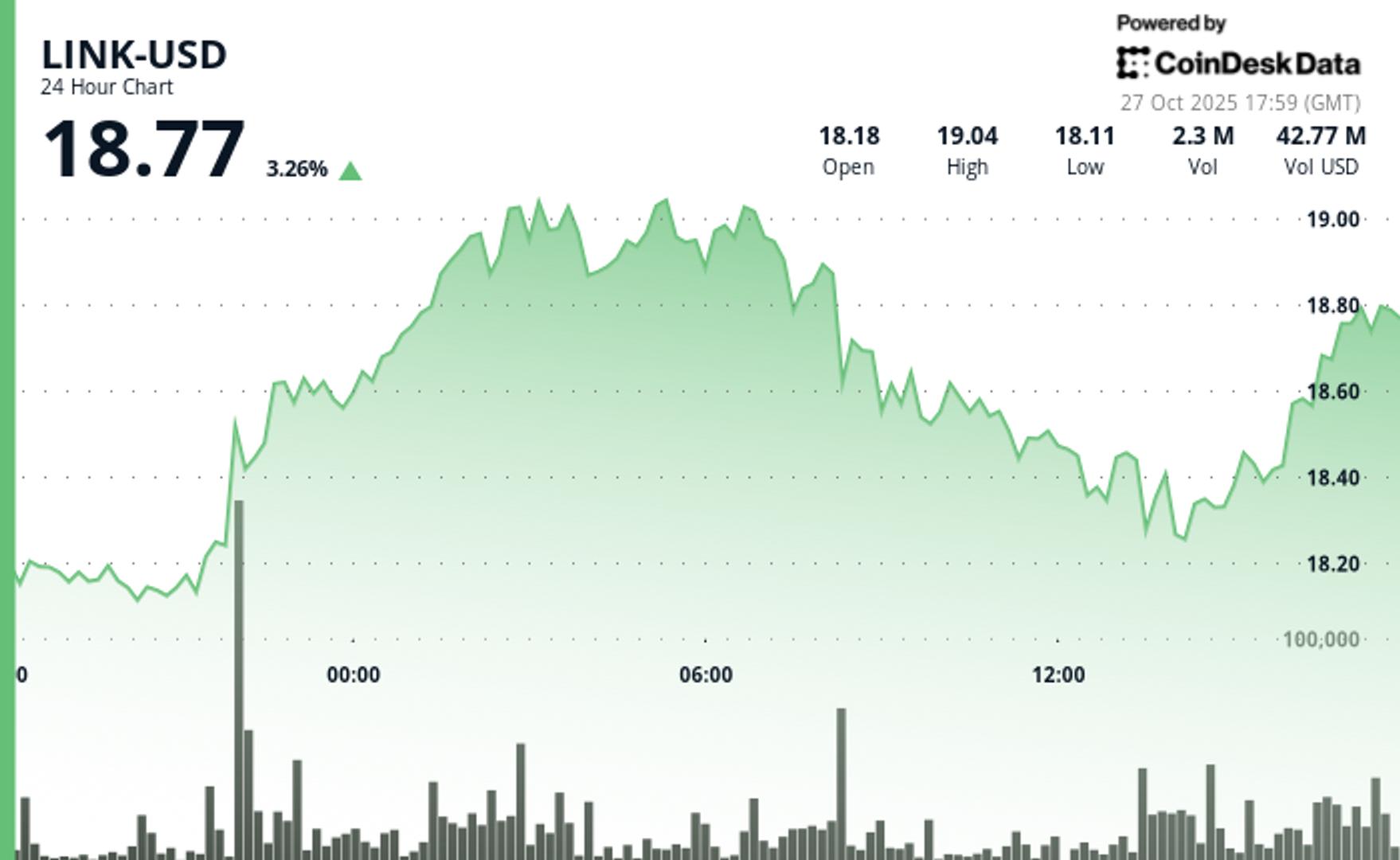

MegaETH ICO oversubscribed within 5 minutes, raising $50M at $1B valuation

PositiveCryptocurrency

The MegaETH ICO has made headlines by raising an impressive $50 million in just five minutes, reflecting a strong investor interest in innovative blockchain solutions. This rapid oversubscription not only highlights the growing confidence in the cryptocurrency market but also sets a significant benchmark for future ICOs. As more investors flock to such projects, it signals a vibrant and evolving landscape in the blockchain sector.

— Curated by the World Pulse Now AI Editorial System