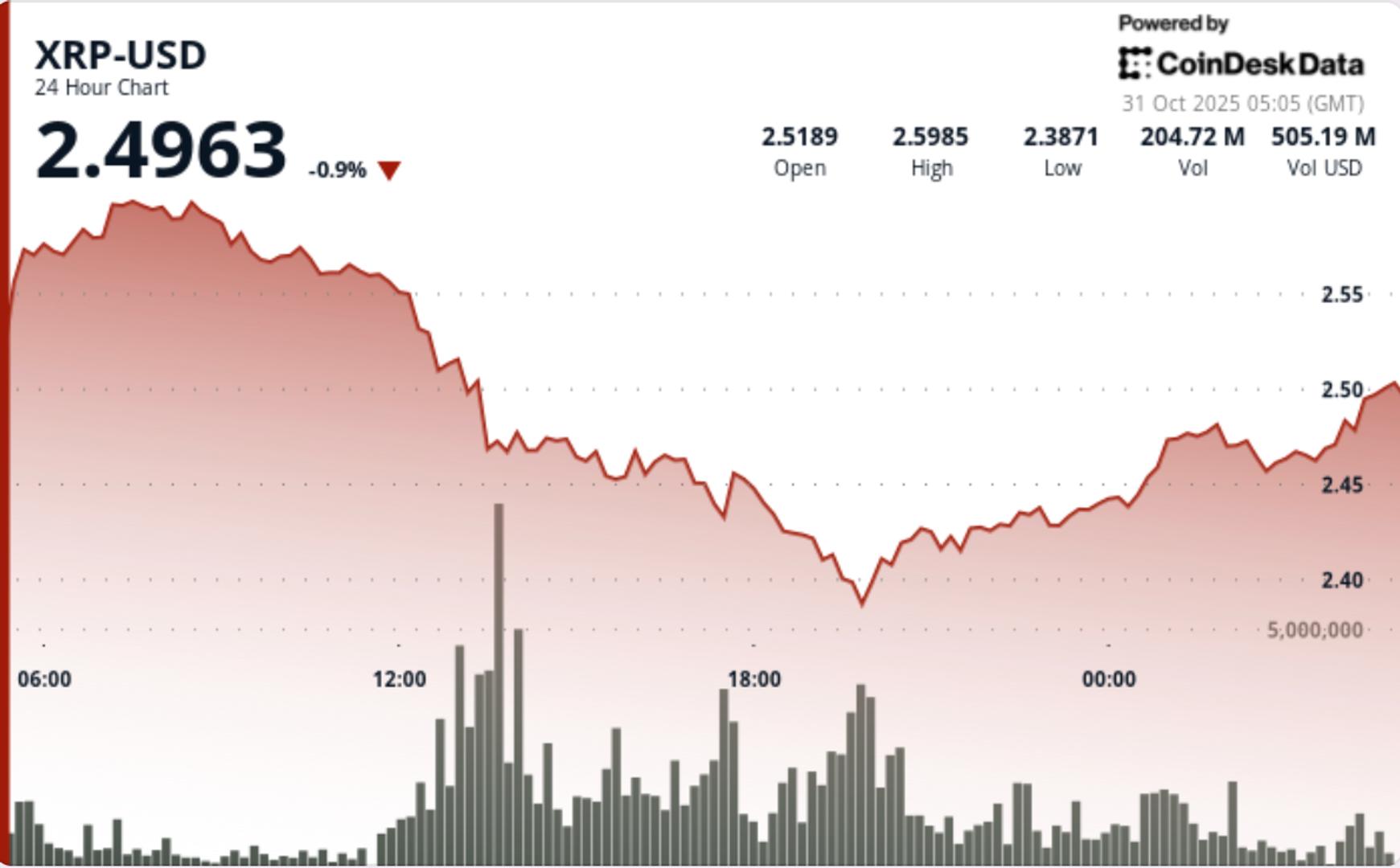

XRP Drops 5% to $2.47 as Bears Break Key Support Level

NegativeCryptocurrency

XRP has seen a significant drop of 5%, now trading at $2.47, as bearish market forces have broken through a crucial support level. This decline is concerning for investors, as it indicates a potential shift in market sentiment and raises questions about the future stability of XRP. Understanding these market movements is essential for anyone involved in cryptocurrency, as they can impact investment strategies and overall market health.

— Curated by the World Pulse Now AI Editorial System