China’s budget AIs are trouncing ChatGPT and Grok at crypto trading

PositiveCryptocurrency

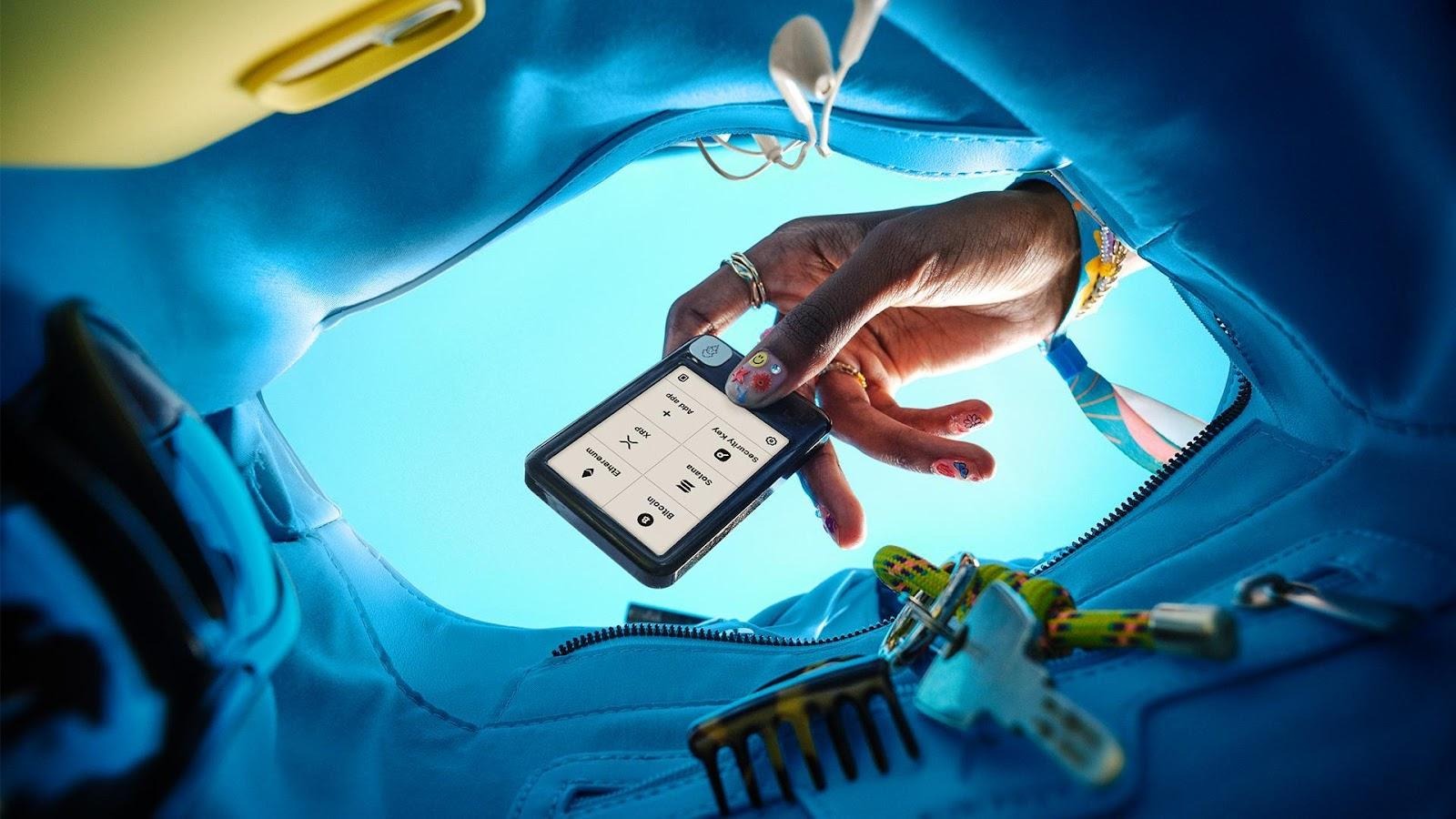

In a surprising turn of events, China's budget AI model, DeepSeek, has outperformed both ChatGPT and Grok in crypto trading, generating positive returns despite its smaller development budget. This achievement highlights the potential of cost-effective AI solutions in the competitive world of cryptocurrency, suggesting that innovation doesn't always require hefty investments. As the crypto market continues to evolve, the success of DeepSeek could inspire further advancements in AI technology and trading strategies.

— Curated by the World Pulse Now AI Editorial System