5 Months To $50? XRP’s ‘Alignment’ Has Traders On Edge

PositiveCryptocurrency

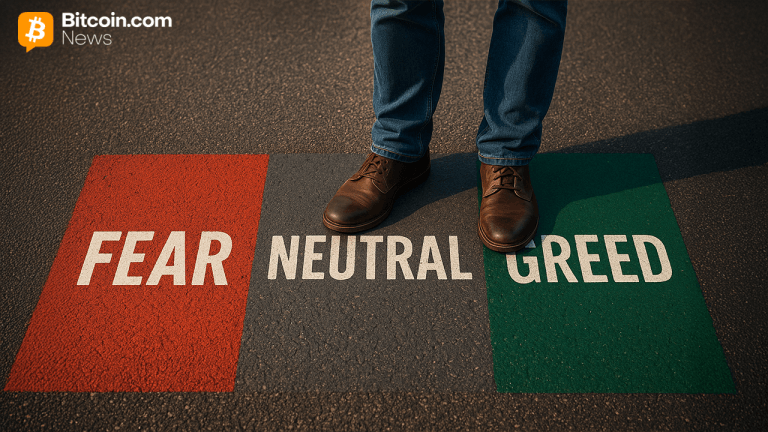

Veteran investor Pumpius believes XRP is on the brink of a significant price surge, potentially reaching up to $50 in just five months. He identifies nine key catalysts that could drive this increase, including recent developments with the SEC speeding up ETF reviews. This news is crucial for traders and investors as it highlights the growing institutional interest in cryptocurrencies, particularly XRP, which could lead to substantial market shifts.

— Curated by the World Pulse Now AI Editorial System