HBAR Declines 4% Following ETF Debut as Initial Euphoria Fades

NegativeCryptocurrency

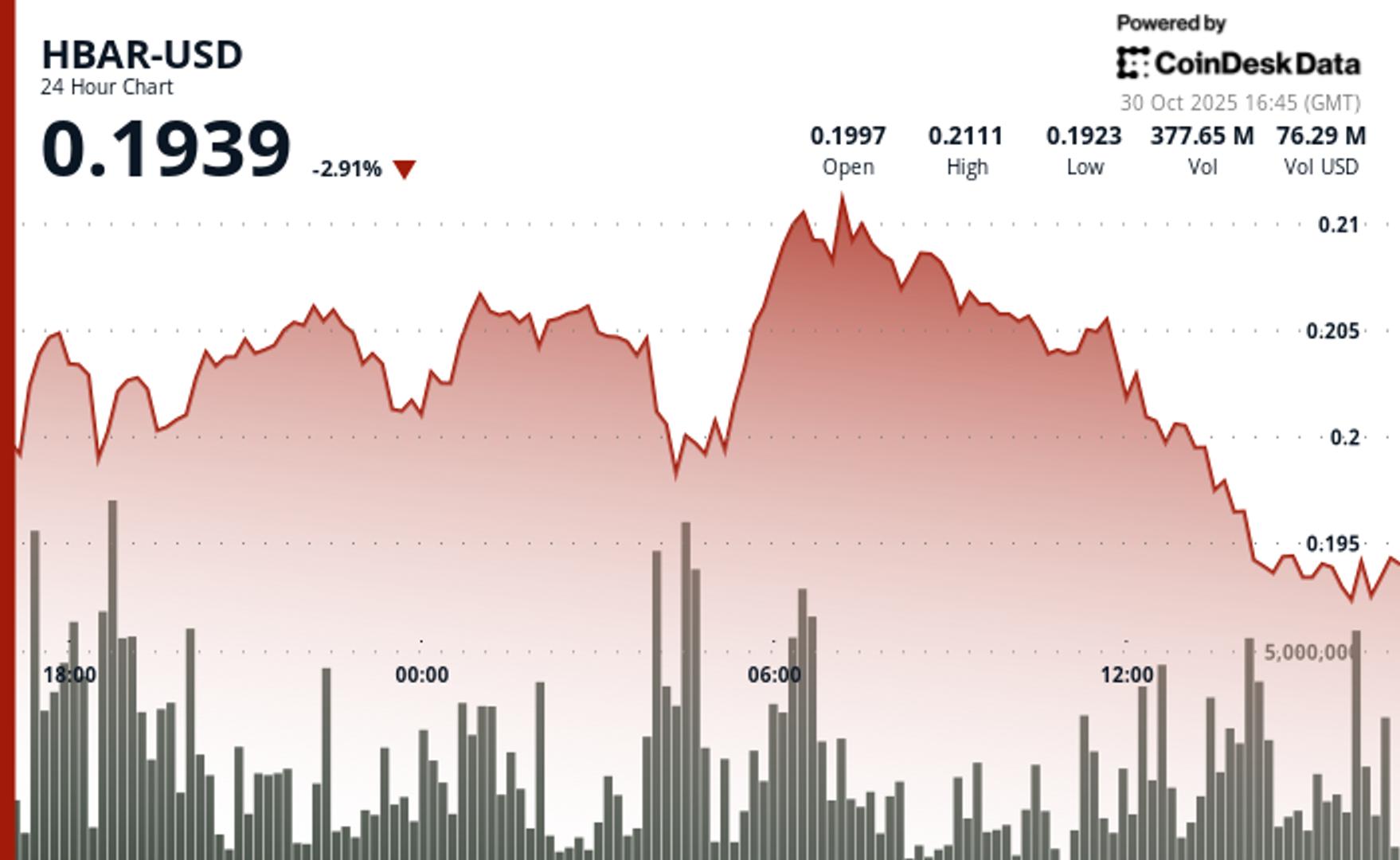

Hedera's price has dropped by 4% to $0.1925 following the much-anticipated debut of a spot ETF on Nasdaq. This decline comes as initial excitement fades and profit-taking sets in, highlighting the volatility often seen in the cryptocurrency market. The ETF launch was a significant milestone for institutional investment in digital assets, but the immediate reaction shows that market dynamics can shift quickly, reminding investors to stay cautious.

— Curated by the World Pulse Now AI Editorial System