Find Mining introduces a new mobile-based mining solution for its users

PositiveCryptocurrency

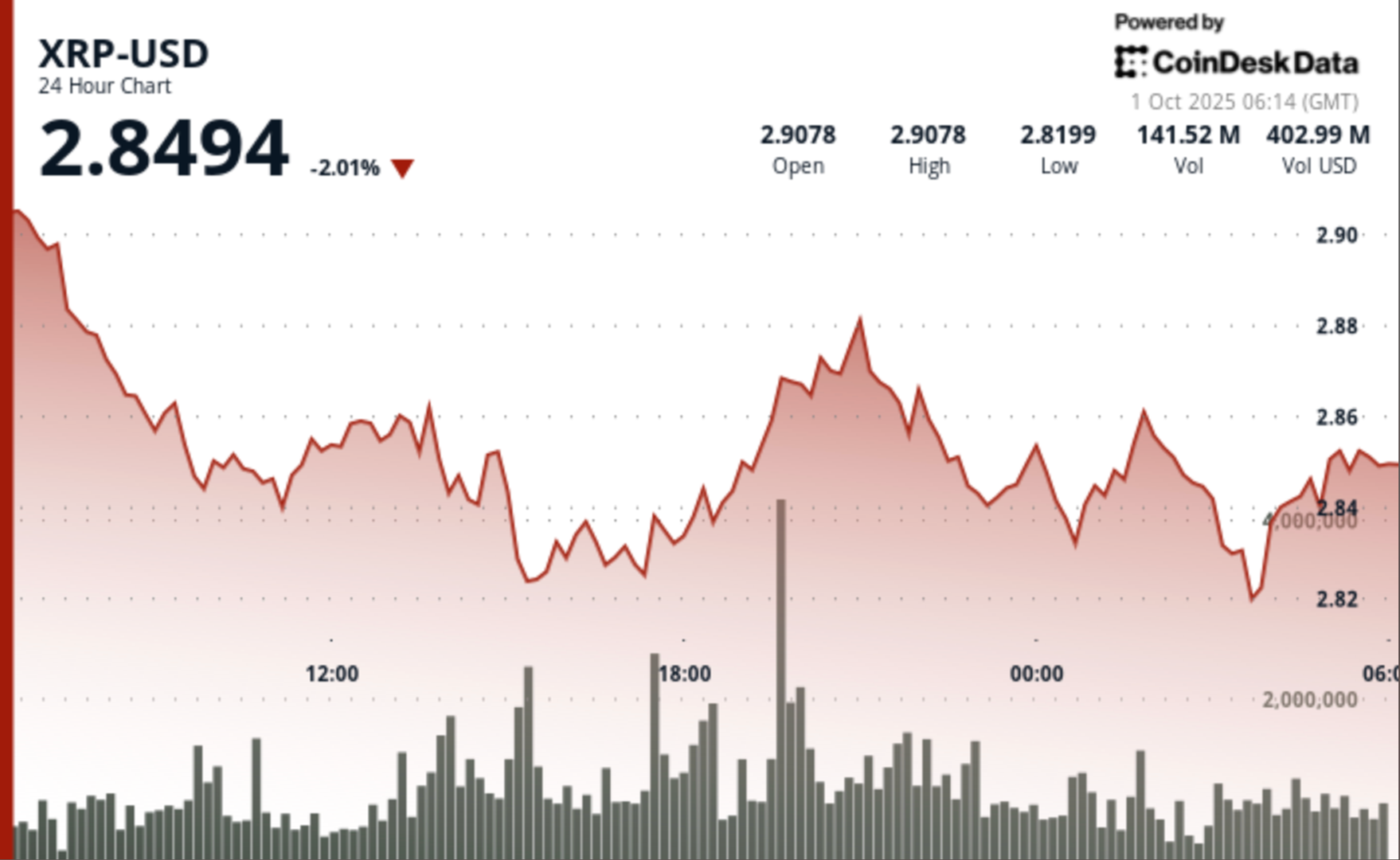

Find Mining has launched a new mobile-based mining solution that provides an exciting income alternative for XRP holders, especially after the cryptocurrency experienced a significant 25% drop in September. This innovative app could help users navigate the volatile market by offering a more accessible way to engage in mining, potentially boosting their earnings and enhancing their investment strategies.

— Curated by the World Pulse Now AI Editorial System