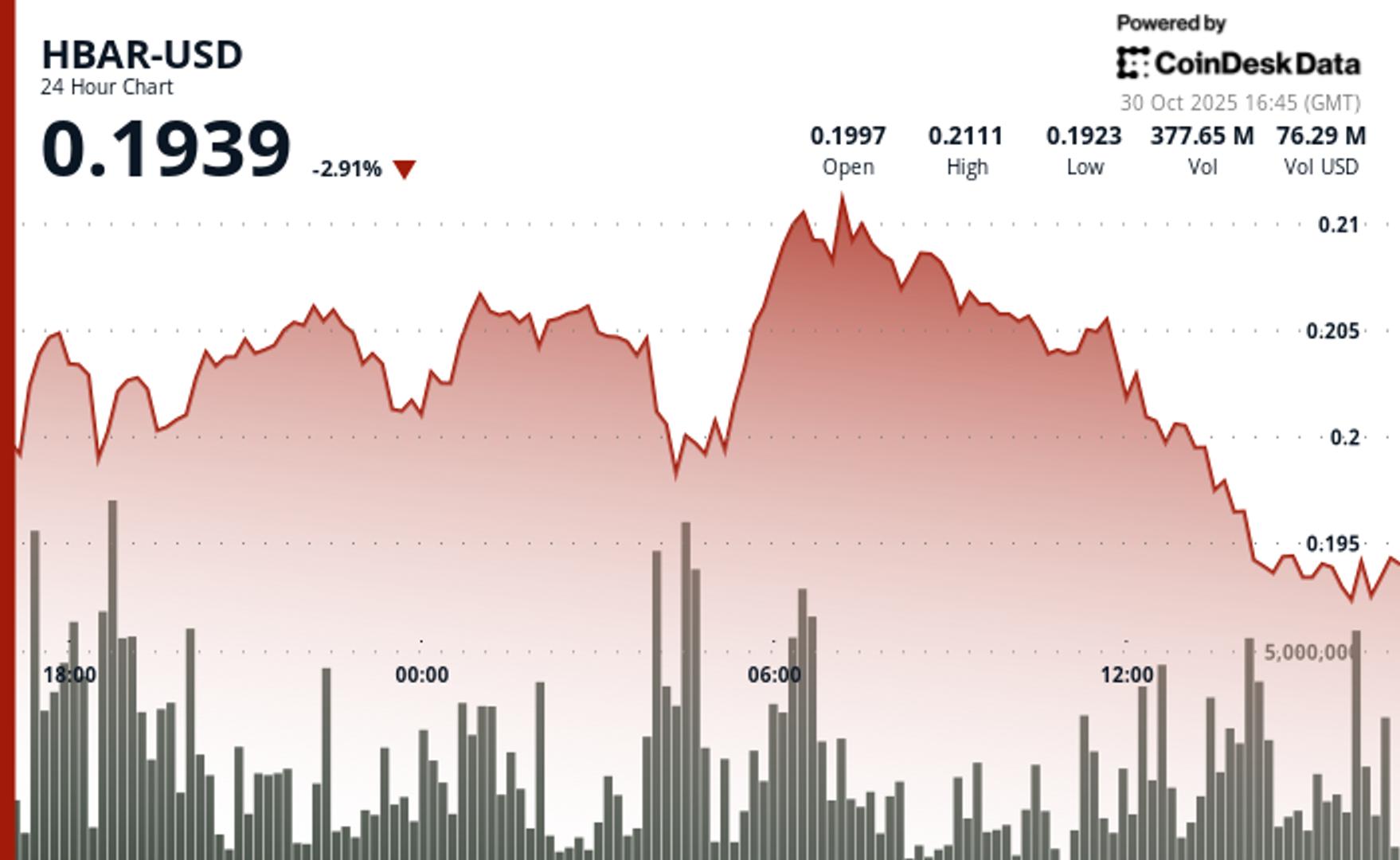

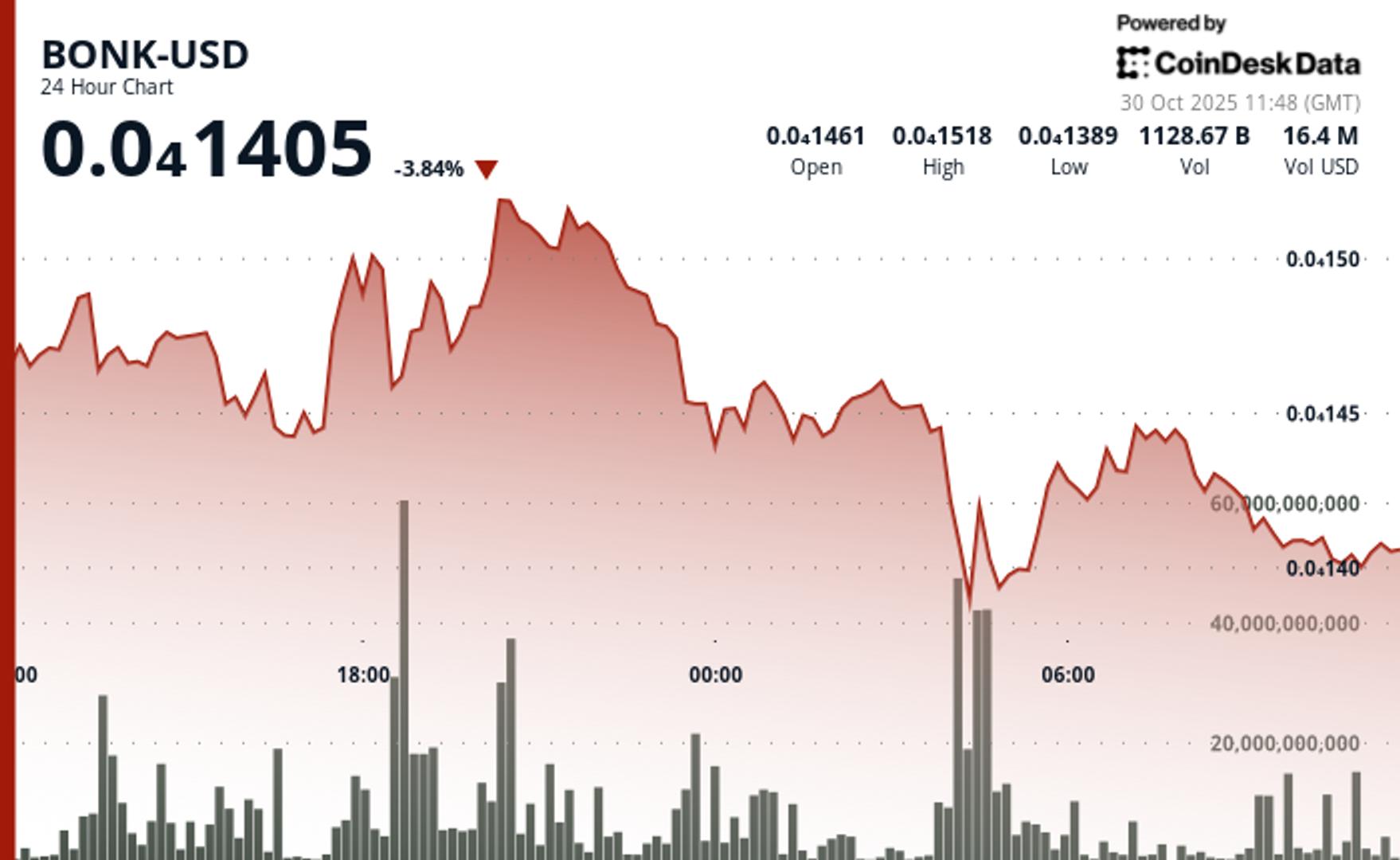

Crypto Traders Take on $800M Liquidations as Fed’s Caution Sparks ‘Sell-the-News’ Reversal

NegativeCryptocurrency

In a surprising turn of events, crypto traders faced a staggering $800 million in liquidations as the Federal Reserve's cautious stance triggered a 'sell-the-news' reaction in the market. This significant shift highlights the volatility and unpredictability of the cryptocurrency landscape, reminding investors of the risks involved. As traders react to economic signals, the market's response underscores the delicate balance between regulatory news and trading behavior, making it a crucial moment for both seasoned and new investors.

— Curated by the World Pulse Now AI Editorial System