FOMC Rate Cuts Loom as Bitcoin Holds Above $109,500 EMA

NeutralCryptocurrency

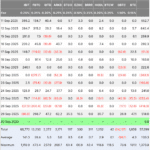

Bitcoin is currently holding steady above the $109,500 EMA, but its weekly chart shows bearish signs as investors are closely watching for signals regarding potential rate cuts from the Federal Open Market Committee (FOMC). This situation is significant as it reflects the ongoing tension in the financial markets, where interest rate changes can greatly influence cryptocurrency prices and investor sentiment.

— Curated by the World Pulse Now AI Editorial System