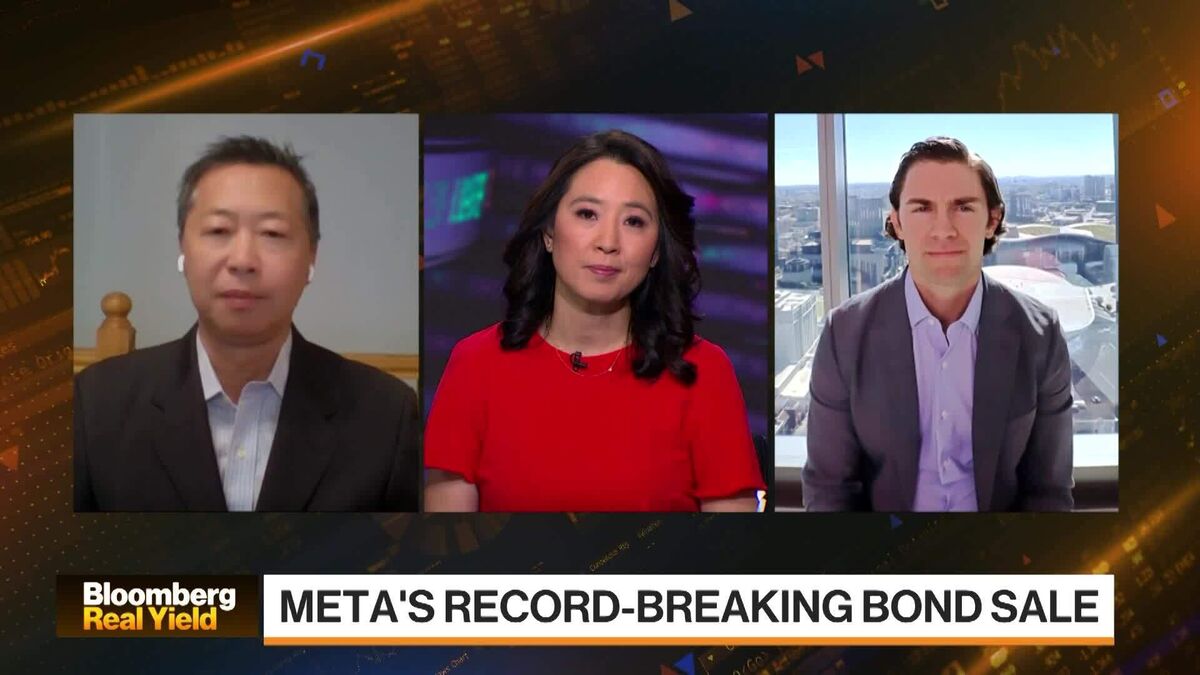

JPMorgan's Michele Says 'Planet Underallocated to Fixed Income'

PositiveFinancial Markets

Bob Michele, the global head of fixed income at JPMorgan Asset Management, recently shared his optimistic outlook on the US economy during an interview on Bloomberg. He believes that the economy is poised for a reacceleration in growth next year, which could have significant implications for investors and the fixed income market. This perspective highlights the potential for better returns in fixed income investments, making it a crucial topic for those looking to navigate the changing economic landscape.

— Curated by the World Pulse Now AI Editorial System