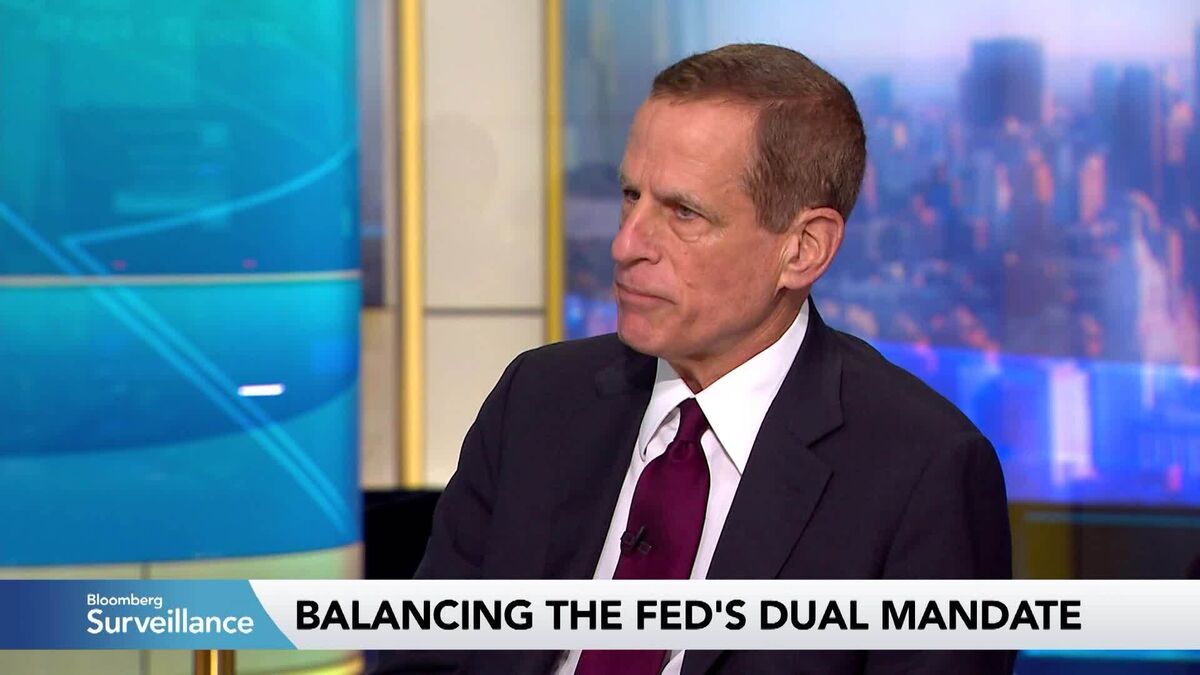

Powell Should Leave The Door Open to Cut in December Says Kaplan

NeutralFinancial Markets

Rob Kaplan, Vice Chairman of Goldman Sachs and former President of the Federal Reserve Bank of Dallas, suggests that the Federal Reserve should consider the possibility of cutting rates in December. His insights come as the Fed prepares for a crucial decision, and he emphasizes the importance of adapting to the evolving landscape of the US economy, particularly with the increasing influence of AI. This discussion is significant as it highlights the potential shifts in monetary policy that could impact economic growth and stability.

— Curated by the World Pulse Now AI Editorial System