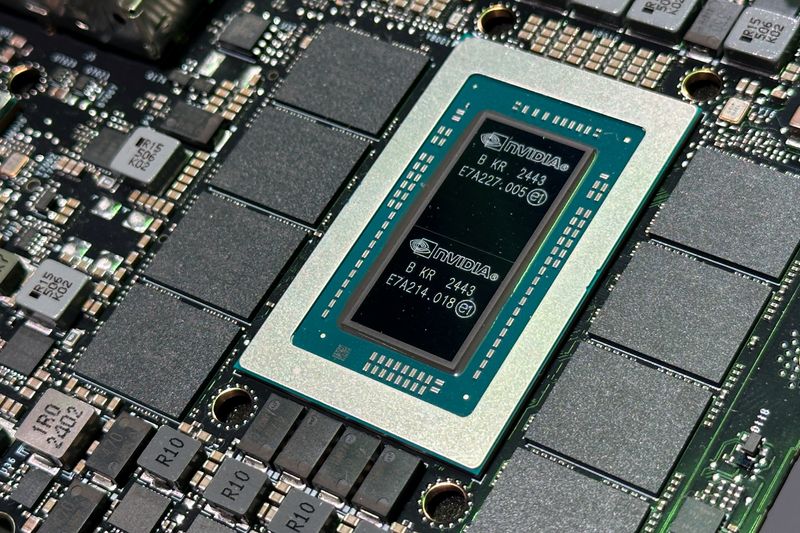

Lucid to launch self-driving mid-size EV with Nvidia chips

PositiveFinancial Markets

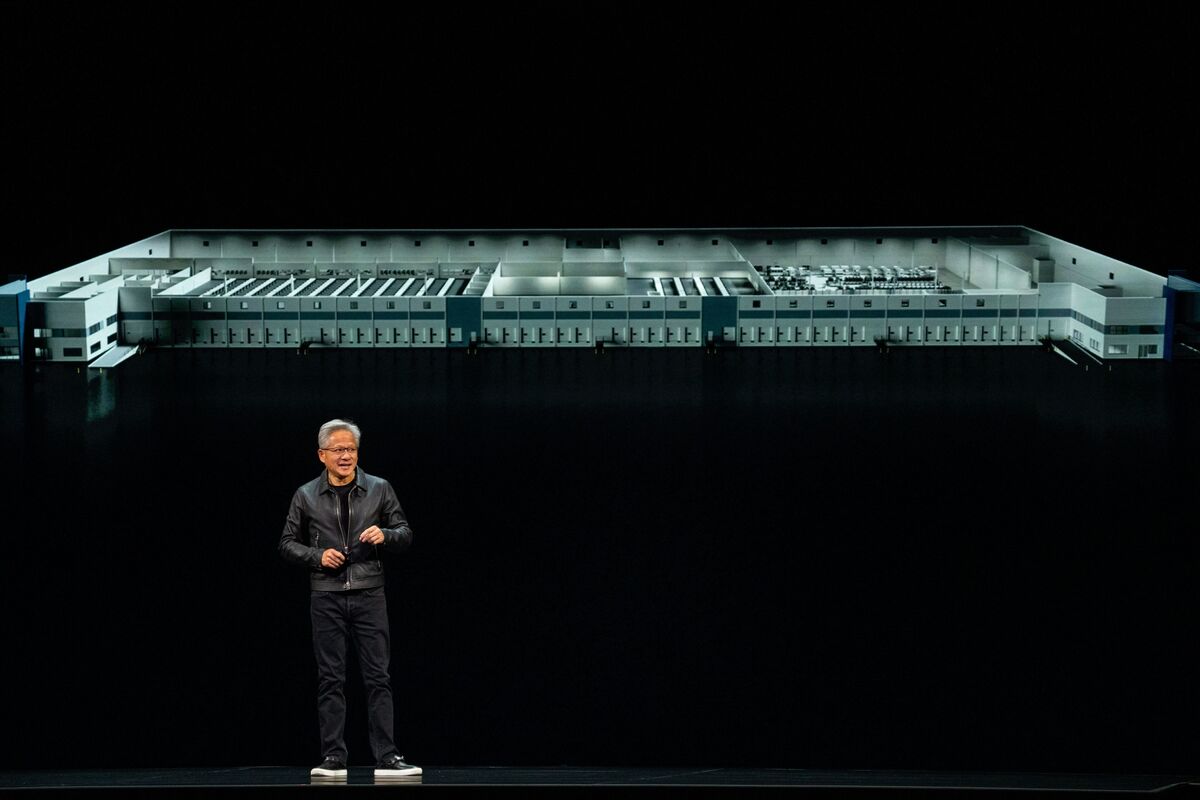

Lucid Motors is set to launch a new mid-size electric vehicle (EV) equipped with advanced self-driving technology powered by Nvidia chips. This development is significant as it showcases Lucid's commitment to innovation in the automotive industry, potentially enhancing the driving experience and safety for consumers. With the growing demand for electric vehicles and autonomous driving features, this launch could position Lucid as a key player in the market.

— Curated by the World Pulse Now AI Editorial System