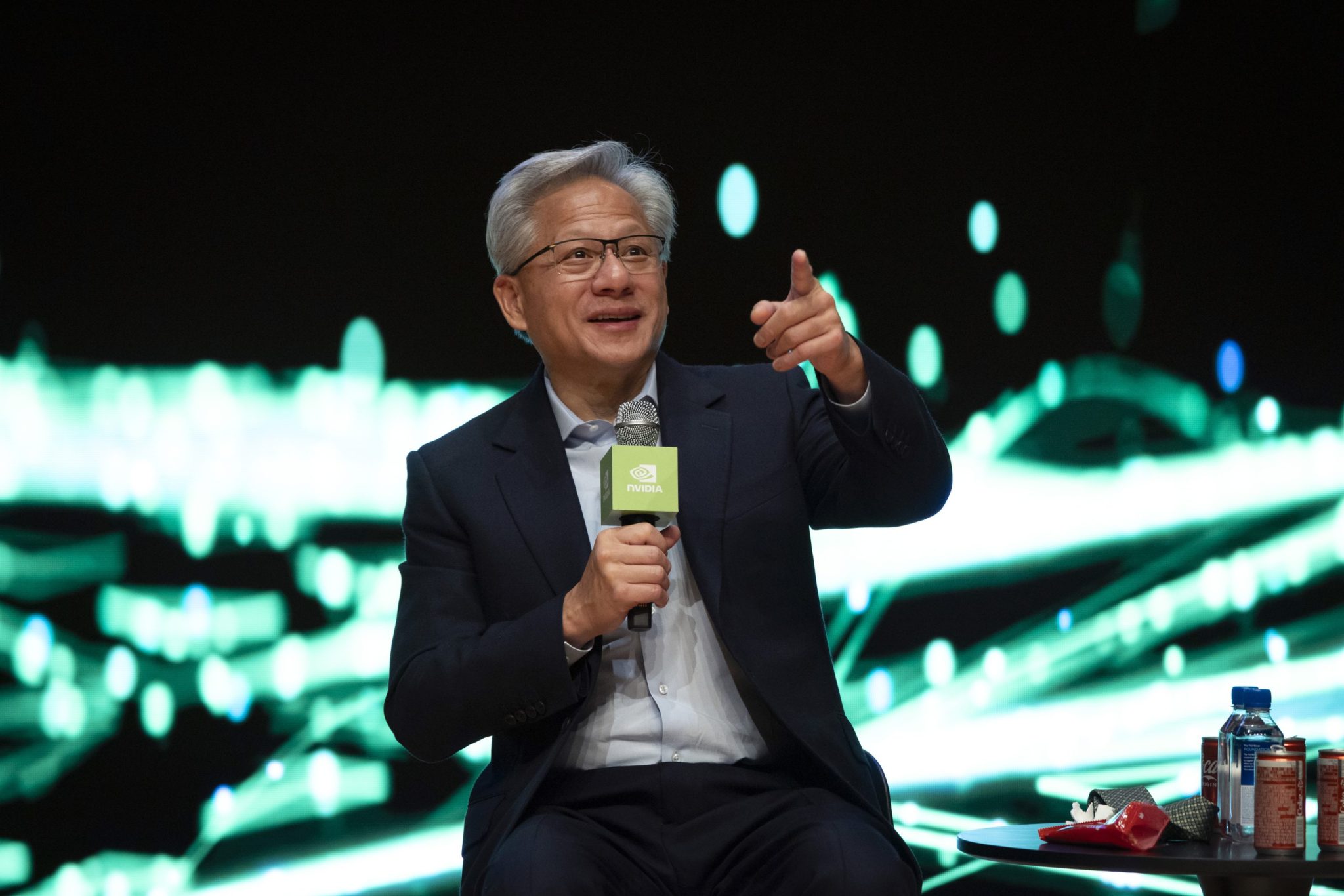

Three billionaires dropped by a fried-chicken joint—and Jensen Huang bought everyone dinner

PositiveFinancial Markets

Nvidia's CEO Jensen Huang recently made headlines after treating three billionaires to dinner at a Korean fried chicken restaurant in Seoul. This unexpected gesture not only delighted the guests but also led to a significant surge in the restaurant's stock prices, showcasing the influence of high-profile figures on the market. It's a reminder of how personal connections and experiences can have a ripple effect in the business world.

— Curated by the World Pulse Now AI Editorial System