Vingroup Seeks $500 Million Private Credit for EV Charging Ports

PositiveFinancial Markets

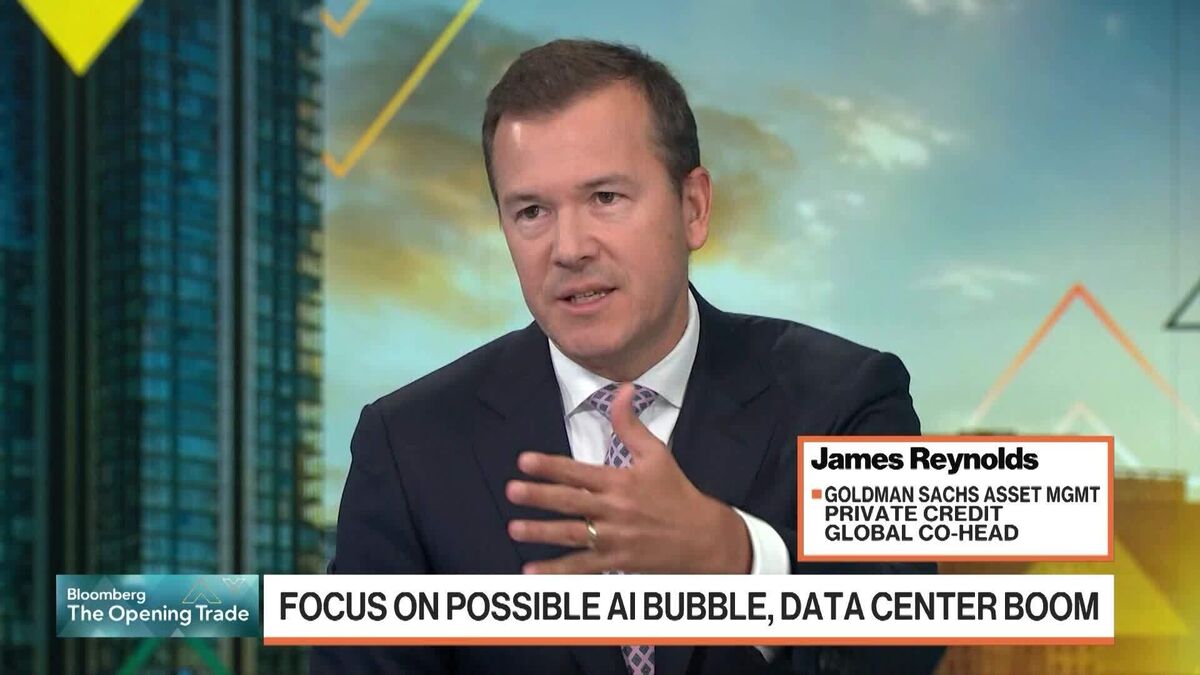

Vingroup JSC, a major Vietnamese conglomerate, is making strides in the electric vehicle sector by seeking a $500 million private credit loan to enhance its network of EV charging stations. This move is significant as it reflects the growing demand for electric vehicles in the region and Vingroup's commitment to supporting sustainable transportation. Expanding the charging infrastructure is crucial for encouraging more consumers to adopt electric vehicles, ultimately contributing to a greener future.

— Curated by the World Pulse Now AI Editorial System