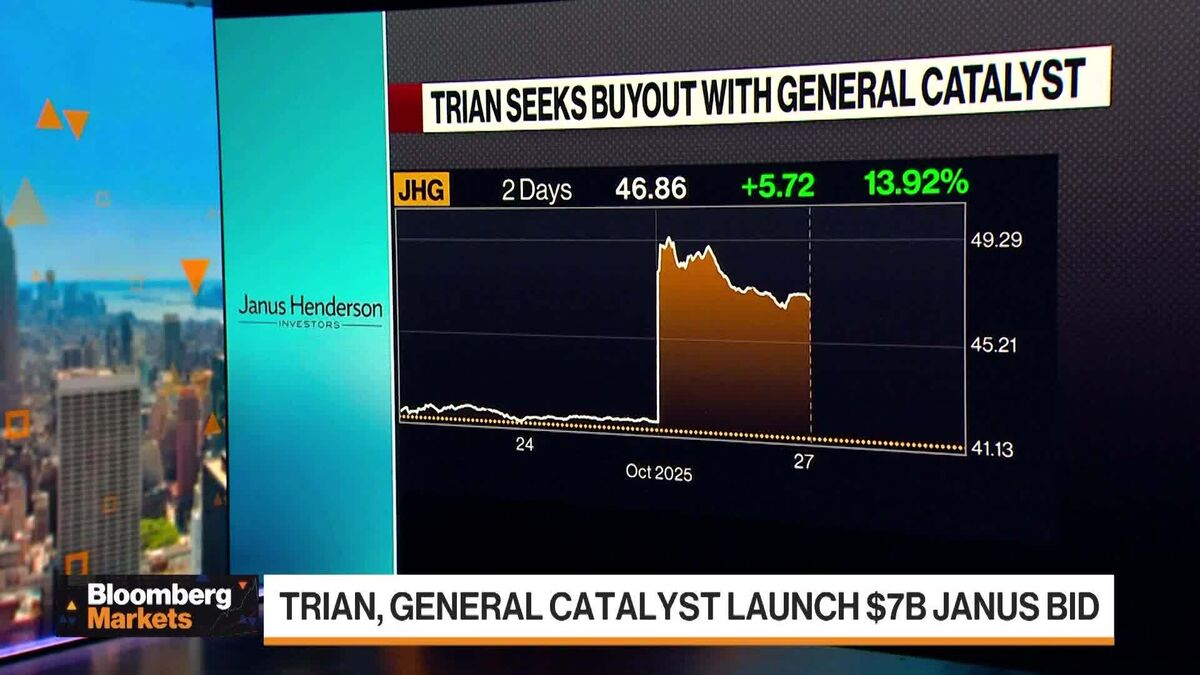

Peltz and General Catalyst lodge $7bn bid for Janus Henderson

PositiveFinancial Markets

Peltz and General Catalyst have made a significant $7 billion bid to take Janus Henderson private, a move that aims to reduce the risks associated with the asset manager's exposure to capital market fluctuations and geopolitical issues. This bid is noteworthy as it reflects confidence in Janus Henderson's potential and could lead to a more stable operational environment, benefiting investors and stakeholders alike.

— Curated by the World Pulse Now AI Editorial System