Oil prices fall as risk premium fades after Gaza deal

PositiveFinancial Markets

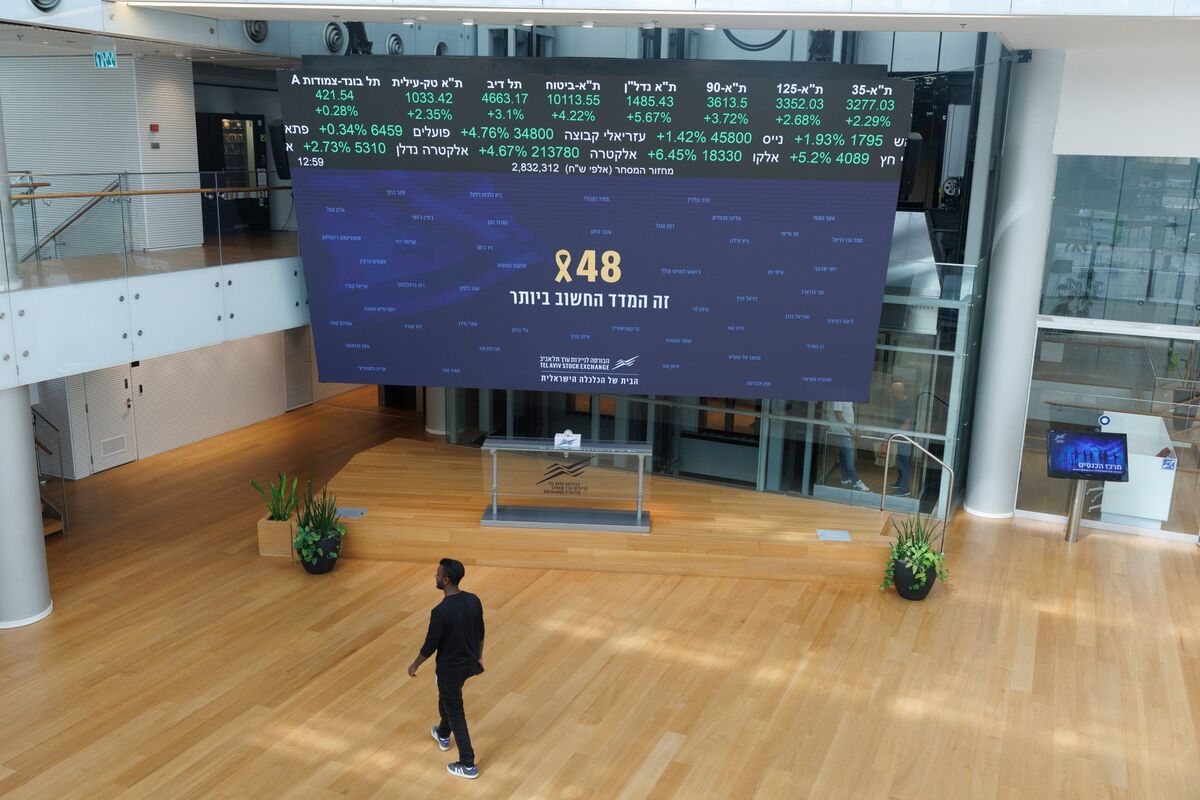

Oil prices have seen a decline following the recent deal in Gaza, which has eased the risk premium that often drives prices up during geopolitical tensions. This drop is significant as it could lead to lower fuel costs for consumers and businesses alike, potentially boosting economic activity. As the situation stabilizes, markets are reacting positively, indicating a return to more predictable pricing.

— Curated by the World Pulse Now AI Editorial System