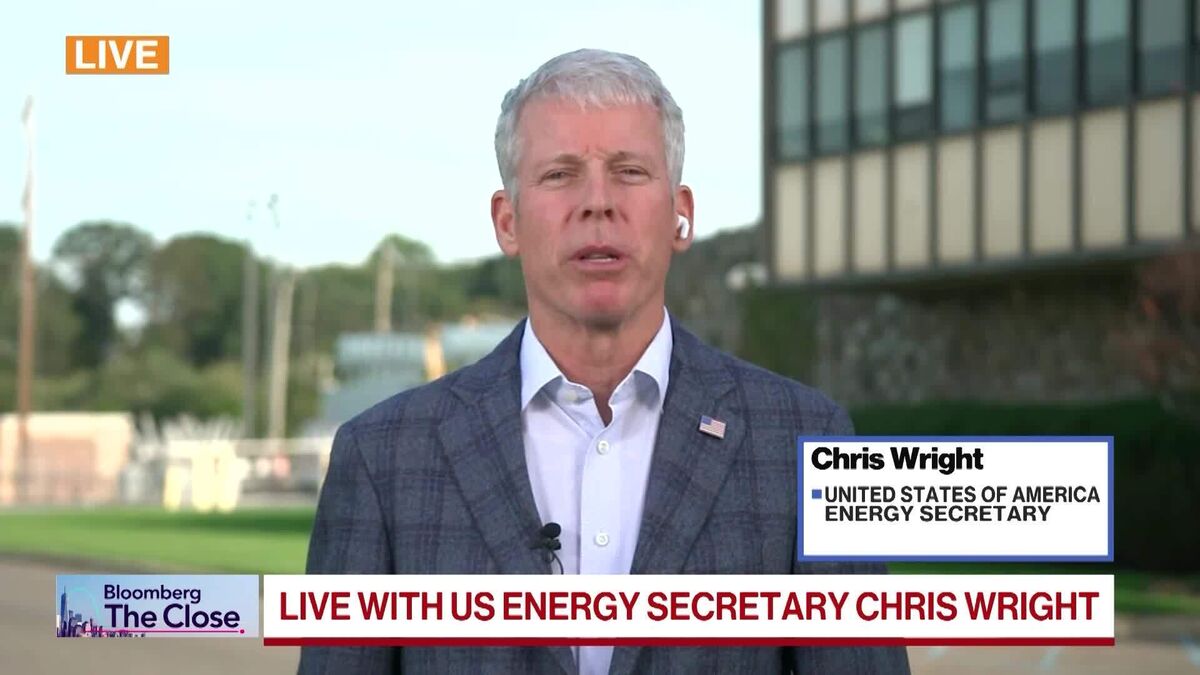

Energy Sec. Wright on Power Grid, Lithium Americas Stake

PositiveFinancial Markets

US Energy Secretary Chris Wright recently announced the government's decision to acquire a stake in Lithium Americas, which is a significant move for the Canadian company as it advances its Thacker Pass lithium project in Nevada. This investment not only supports the growth of renewable energy resources but also highlights the government's commitment to enhancing domestic lithium production, crucial for electric vehicle batteries and other technologies. It's a positive step towards energy independence and sustainability.

— Curated by the World Pulse Now AI Editorial System