Blue Owl Chief Looks to Bank Loans for Dimon Cockroaches

NeutralFinancial Markets

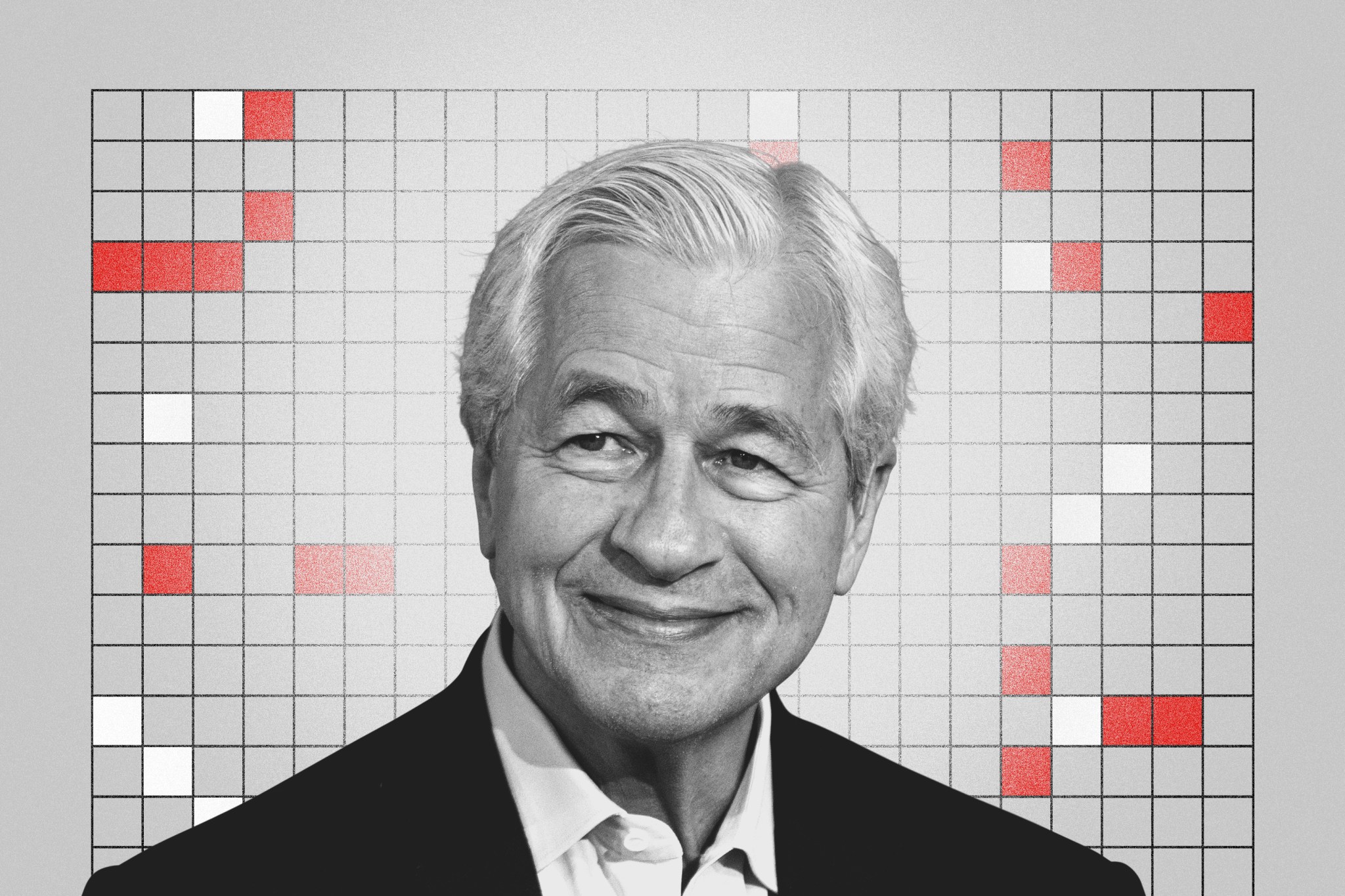

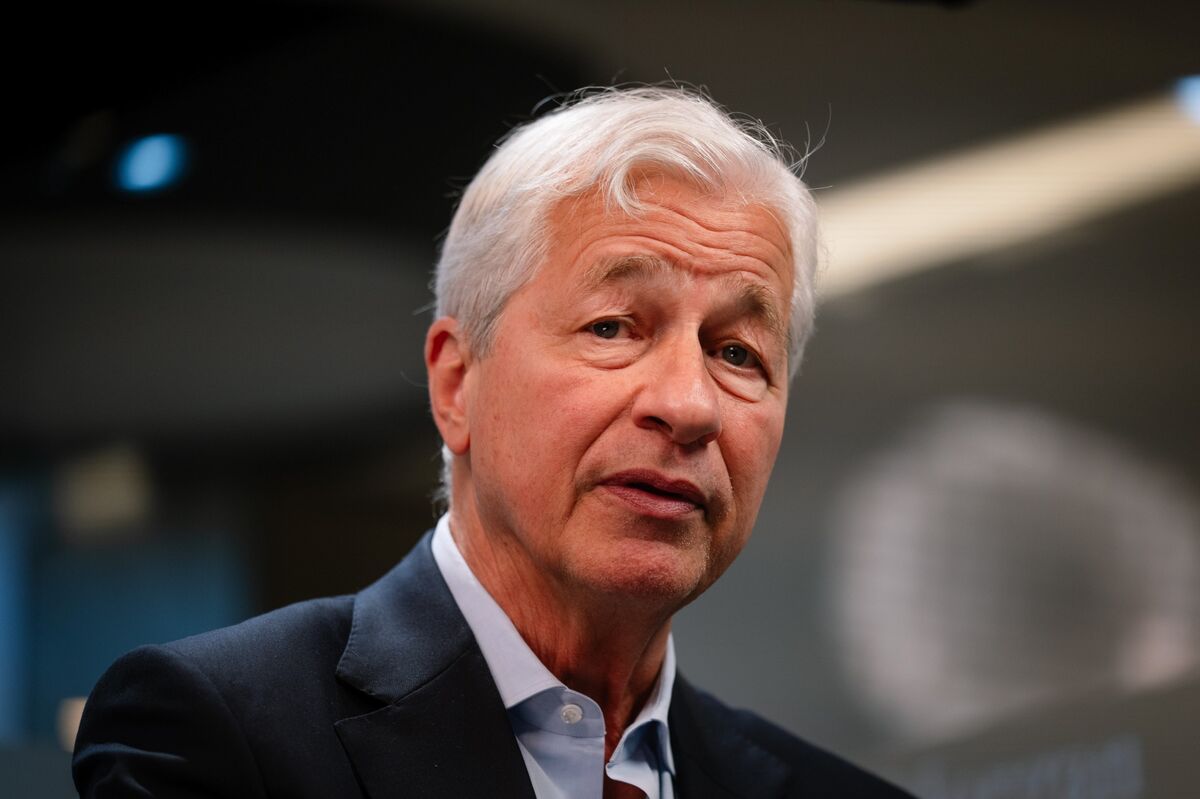

In a recent statement, Marc Lipschultz, co-CEO of Blue Owl Capital, expressed confidence in the stability of the market, noting that defaults are not on the rise and companies are not struggling. This comes in contrast to JPMorgan Chase CEO Jamie Dimon's warnings about potential risks in credit markets following the collapses of Tricolor Holdings and First Brands Group. Lipschultz's remarks highlight a divergence in perspectives on the current economic landscape, suggesting that while some see caution, others remain optimistic about financial health.

— Curated by the World Pulse Now AI Editorial System