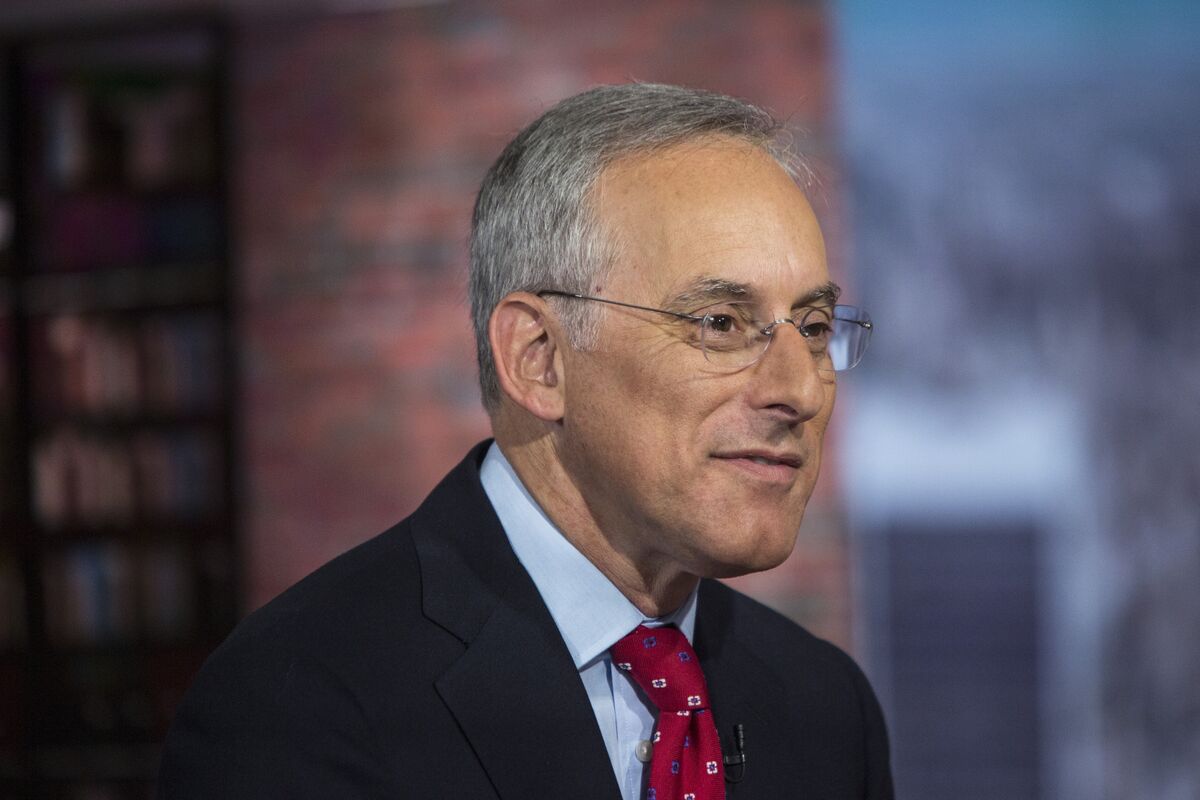

Ed Yardeni lifts S&P 500 price target on resilient U.S. economy

PositiveFinancial Markets

Ed Yardeni has raised his price target for the S&P 500, reflecting his confidence in the resilience of the U.S. economy. This adjustment signals a positive outlook for investors, suggesting that the market may continue to thrive despite economic challenges. Yardeni's insights are particularly relevant as they highlight the strength of economic fundamentals, which could lead to increased investment and growth opportunities.

— Curated by the World Pulse Now AI Editorial System