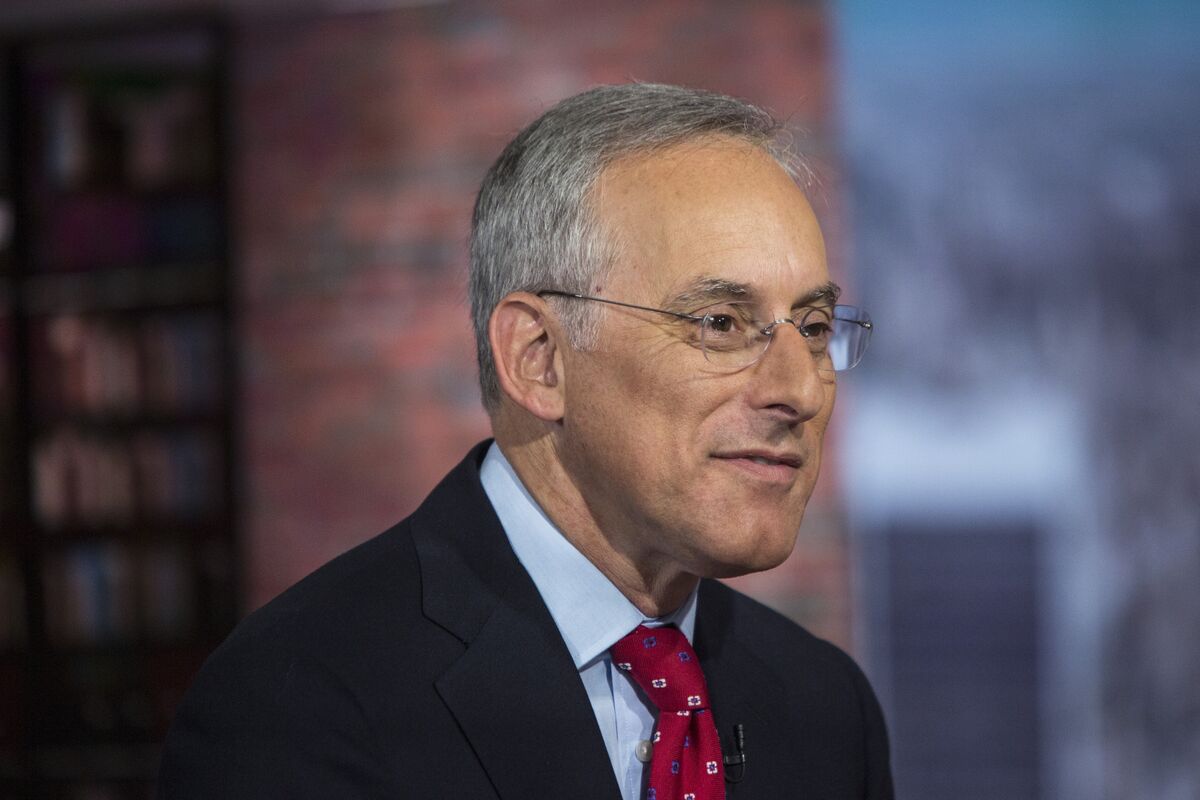

Goldman’s Kostin Says S&P 500 Firms to Beat Low Earnings Bar

PositiveFinancial Markets

Goldman Sachs strategists are optimistic about the upcoming earnings season for US companies, suggesting that expectations have been set too low. With a strong economy and promising developments in artificial intelligence, firms in the S&P 500 are likely to outperform these modest estimates. This is significant as it indicates resilience in the market and could boost investor confidence.

— Curated by the World Pulse Now AI Editorial System