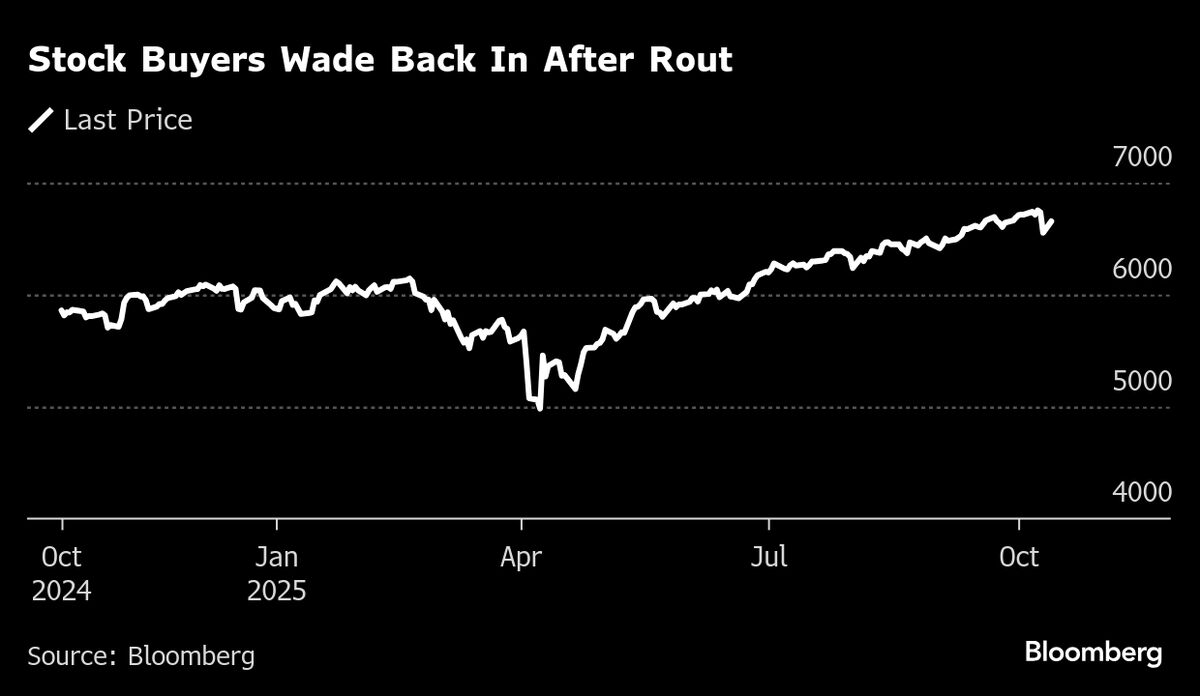

Bitcoin Surges Back to $115,000 After Trump’s Tariff Shock Sparks $19 Billion Crypto Meltdown

PositiveFinancial Markets

Bitcoin has made a remarkable comeback, surging back to $115,000 following a significant $19 billion liquidation in the crypto market triggered by Trump's tariff announcements. This rebound is crucial as it highlights the resilience of cryptocurrencies amidst market volatility and geopolitical tensions. Investors are closely watching how these developments will shape the future of digital currencies.

— Curated by the World Pulse Now AI Editorial System