A Historic Crypto Selloff Erased Over $19 Billion, but Two Accounts Made $160 Million

NeutralFinancial Markets

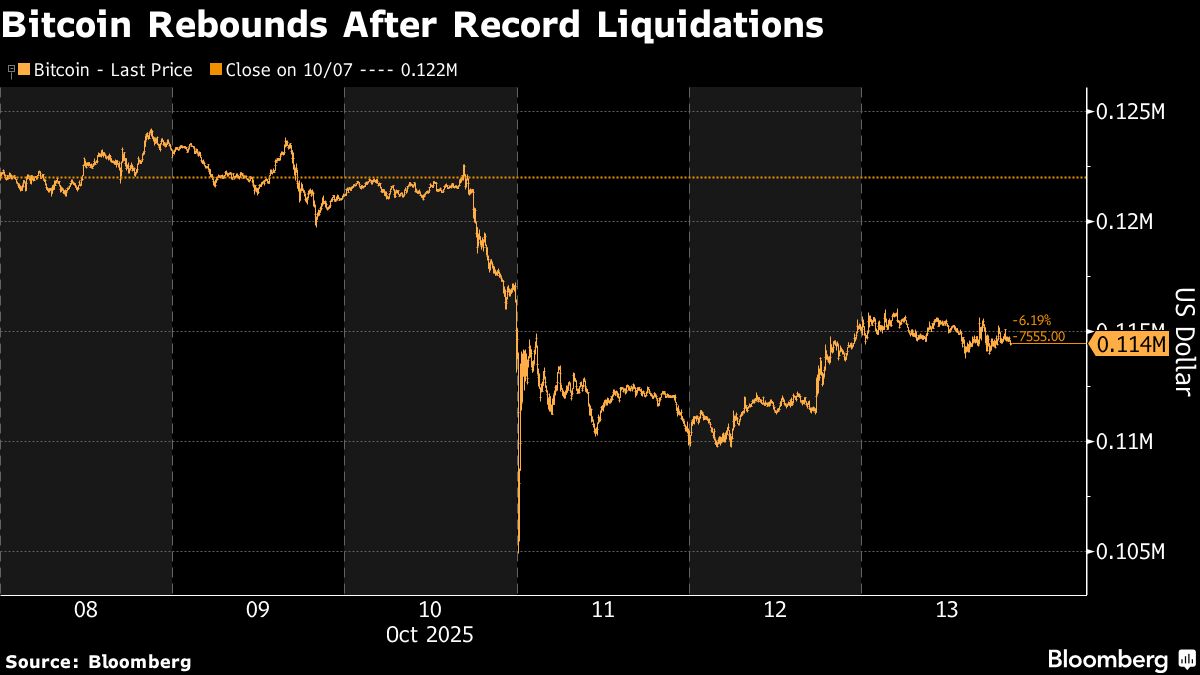

In a significant turn of events, a historic selloff in the cryptocurrency market wiped out over $19 billion in value. However, two savvy accounts on the trading platform Hyperliquid managed to capitalize on this downturn, making a remarkable $160 million by betting against bitcoin and ether. This situation highlights the volatility of the crypto market and the potential for both losses and gains, making it a crucial moment for investors to reassess their strategies.

— Curated by the World Pulse Now AI Editorial System