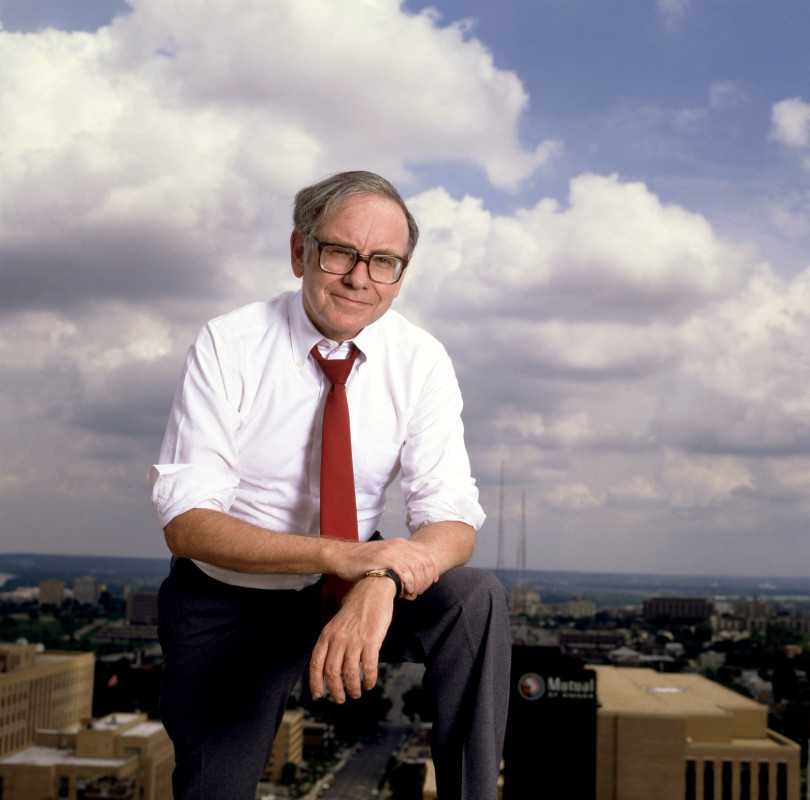

Warren Buffett’s most insightful investing quotes as he celebrates retirement

PositiveFinancial Markets

Warren Buffett, the legendary investor, is celebrating his retirement, and in doing so, he's sharing some of his most insightful investing quotes. His wisdom, drawn from years of experience, not only highlights his investment strategies but also serves as inspiration for both seasoned investors and newcomers alike. These quotes encapsulate his philosophy on investing and life, making them valuable lessons that resonate beyond the stock market.

— Curated by the World Pulse Now AI Editorial System