Chevron CFO Sees Oil Slump Persisting Into 2026 on Ample Supply

NegativeFinancial Markets

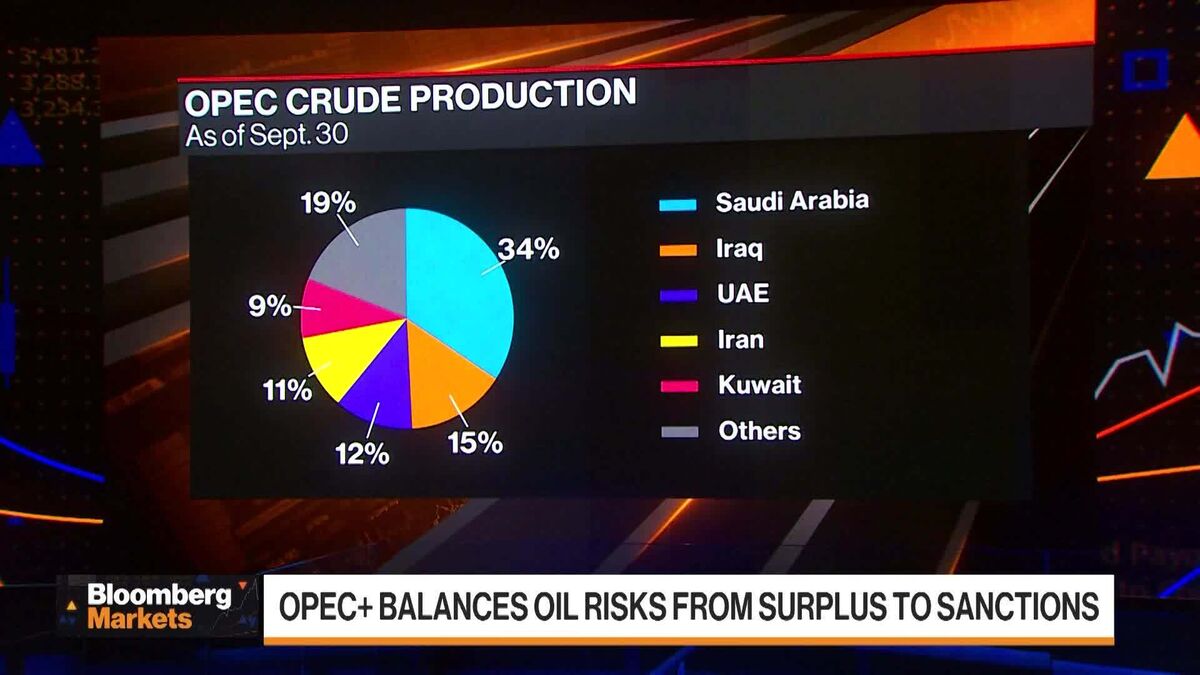

Chevron's CFO, Eimear Bonner, has warned that the current slump in oil prices could continue into 2026 due to strong production levels from OPEC+ and other countries. This situation is significant as it highlights ongoing challenges in the oil market, which could impact energy prices and economic stability globally.

— Curated by the World Pulse Now AI Editorial System