OPEC+ Balances Oil Risks from Sanctions, Illumina 3Q Beats Estimates | Bloomberg Markets 10/31/2025

NeutralFinancial Markets

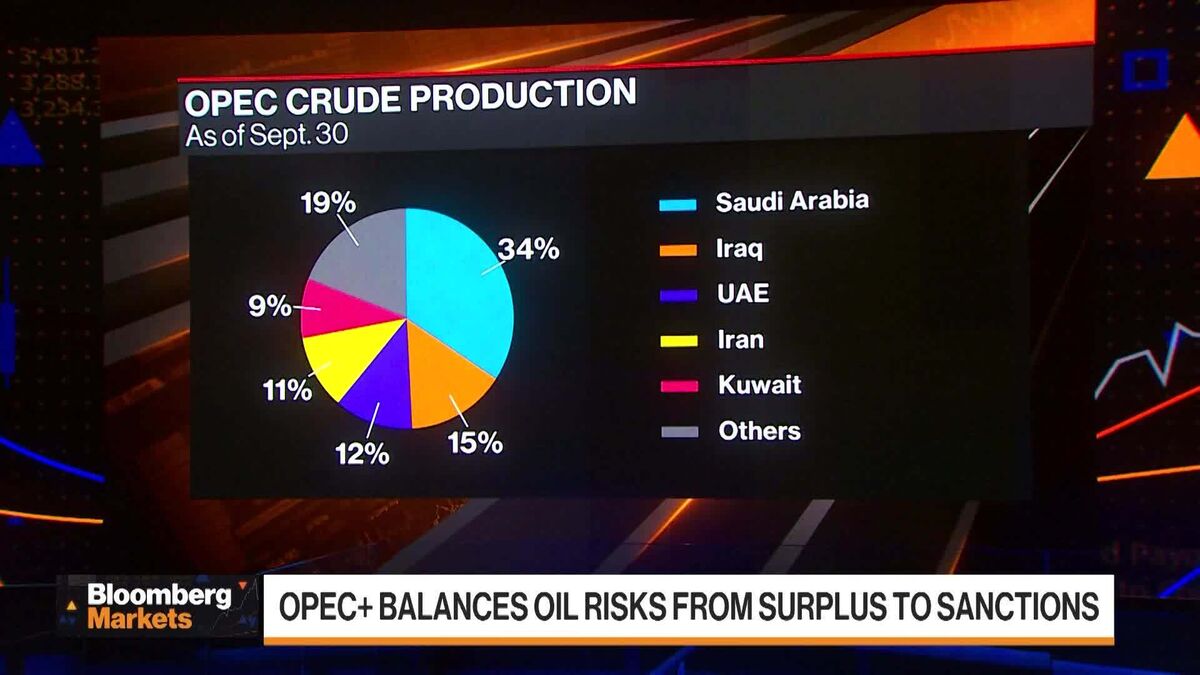

In a recent episode of Bloomberg Markets, the discussion centered around OPEC+'s strategies to manage oil market risks amid ongoing sanctions and the impressive third-quarter performance of Illumina, which exceeded analysts' expectations. This matters because it highlights the delicate balance OPEC+ must maintain in a volatile global market while also showcasing the resilience of companies like Illumina, which can thrive even in challenging economic conditions.

— Curated by the World Pulse Now AI Editorial System