Surrogacy Is a Multibillion-Dollar Business. Sometimes the Money Goes Missing.

NegativeFinancial Markets

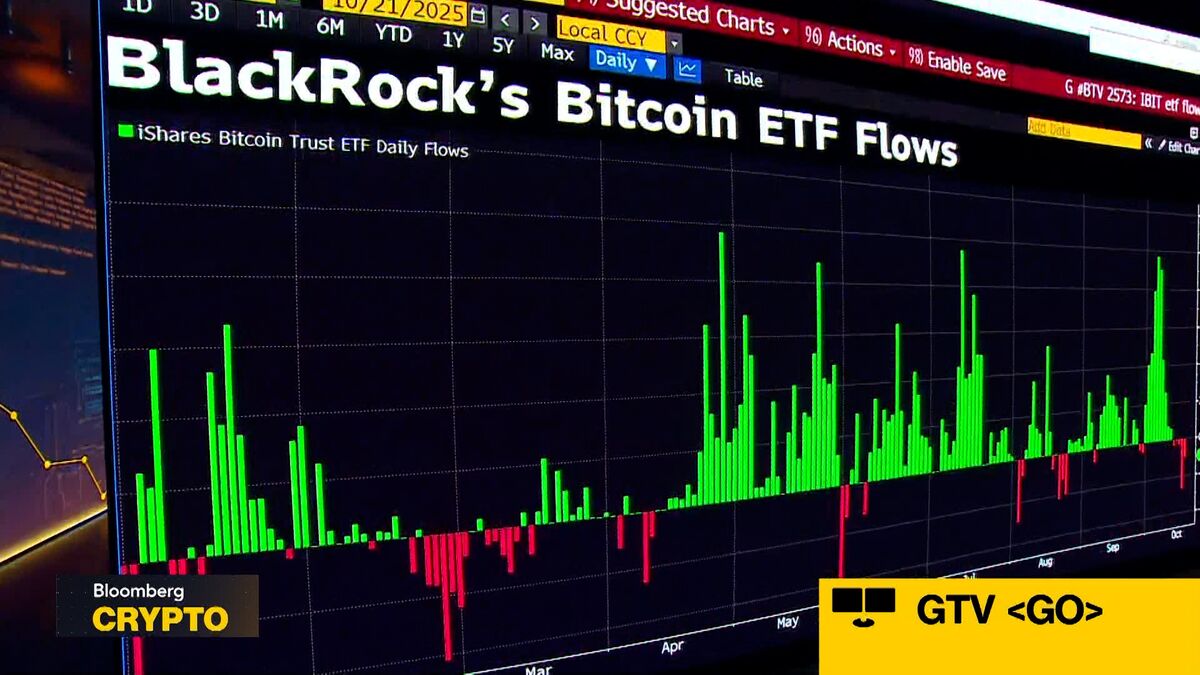

The surrogacy industry, now a multibillion-dollar business, is facing serious scrutiny due to a lack of regulation and alarming cases of financial abuse. Reports indicate that funds meant for surrogacy arrangements are sometimes misappropriated for gambling debts or even invested in cryptocurrencies like bitcoin. This raises significant concerns about the safety and integrity of financial transactions in such a sensitive area, highlighting the urgent need for stricter oversight to protect all parties involved.

— Curated by the World Pulse Now AI Editorial System