Fed’s Barr Skeptical About Looking Past Tariff Inflation

NeutralFinancial Markets

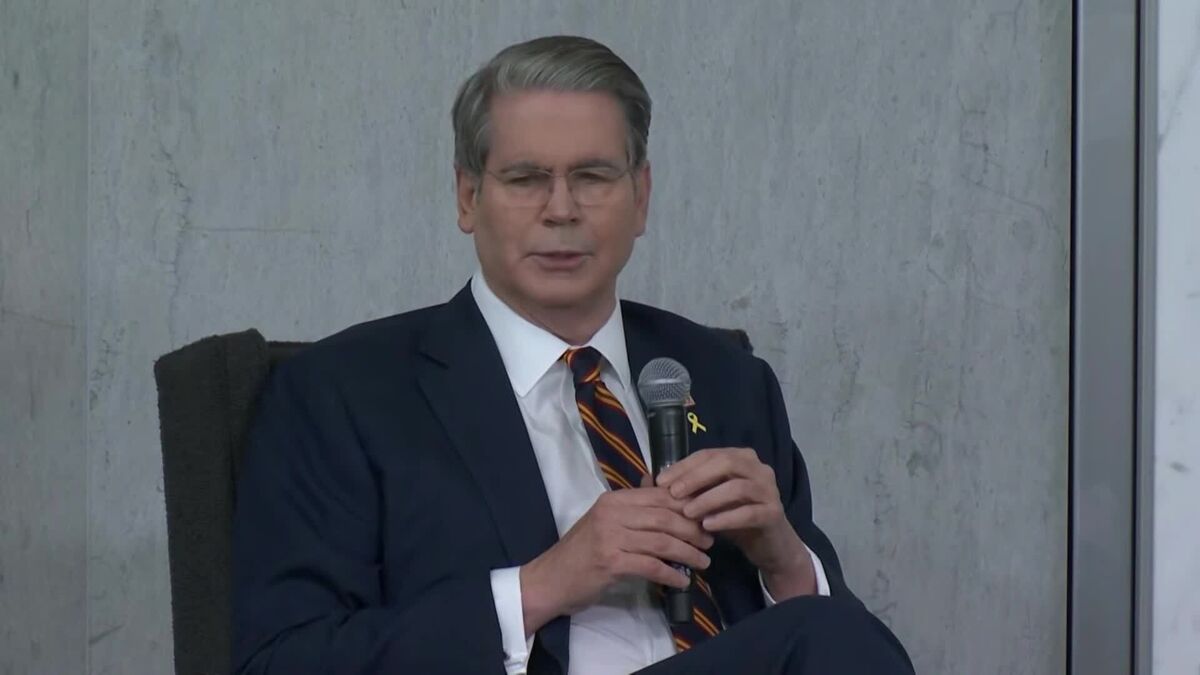

Federal Reserve Governor Michael Barr recently expressed skepticism about the potential for further interest-rate cuts, highlighting concerns that tariffs could lead to ongoing inflation. Speaking at an event with the Economic Club of Minnesota, Barr's cautious stance reflects the complexities of managing economic policy in the face of external pressures. This matters because it signals the Fed's careful approach to navigating inflationary risks, which could impact economic growth and consumer spending.

— Curated by the World Pulse Now AI Editorial System