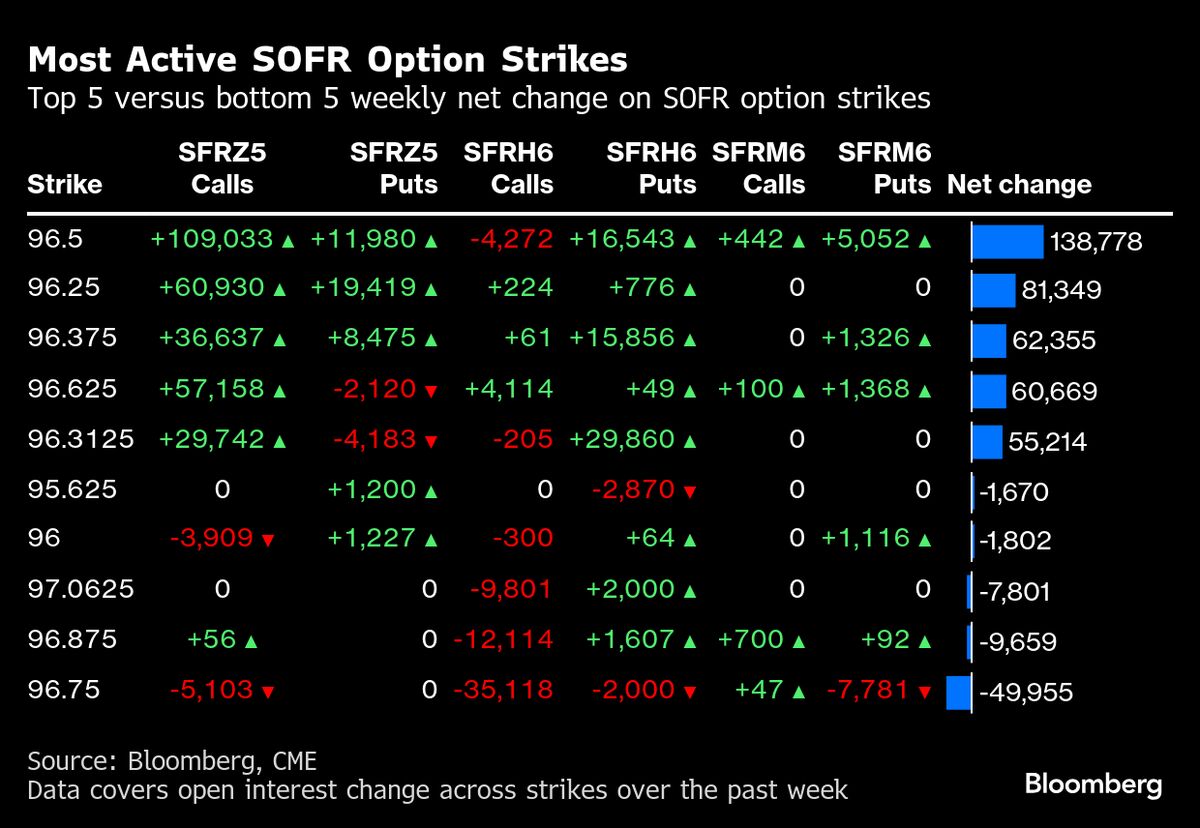

Traders Ramp Up Bets on Half-Point Fed Rate Cut by Year-End

PositiveFinancial Markets

Traders are increasingly confident that the Federal Reserve will implement a significant interest-rate cut by the end of the year, suggesting a shift towards more aggressive monetary policy. This optimism reflects a growing belief that economic conditions may warrant such a move, which could stimulate growth and impact various sectors positively.

— Curated by the World Pulse Now AI Editorial System