Energy Sec. Wright on US Energy to China, South Korea

PositiveFinancial Markets

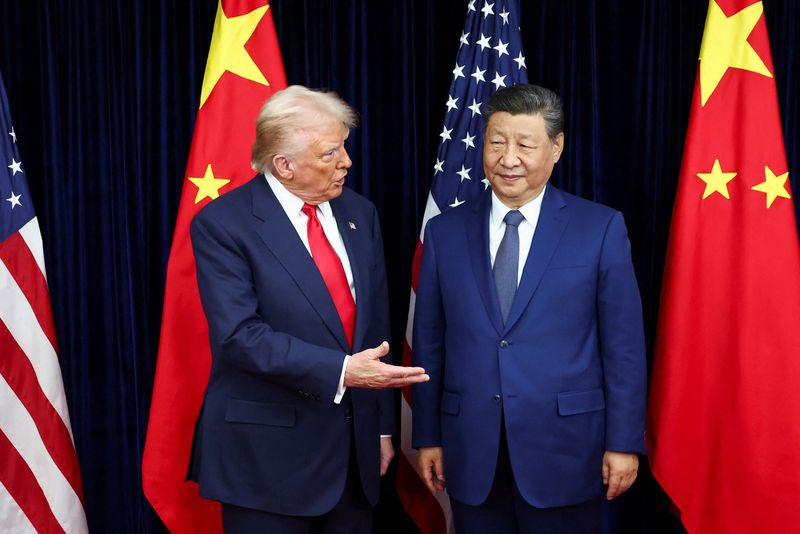

US Energy Secretary Chris Wright is set to travel to Asia soon, following President Trump's announcement that China will increase its purchase of US energy as part of a trade agreement. This development is significant as it not only strengthens US-China trade relations but also highlights the growing importance of energy exports in the global market. Additionally, Wright's discussions on meeting electricity demands for artificial intelligence and energy exports to Europe indicate a forward-thinking approach to energy management.

— Curated by the World Pulse Now AI Editorial System