Ares’ deVeer on AI Data Center Boom, Inflation Concerns

NeutralFinancial Markets

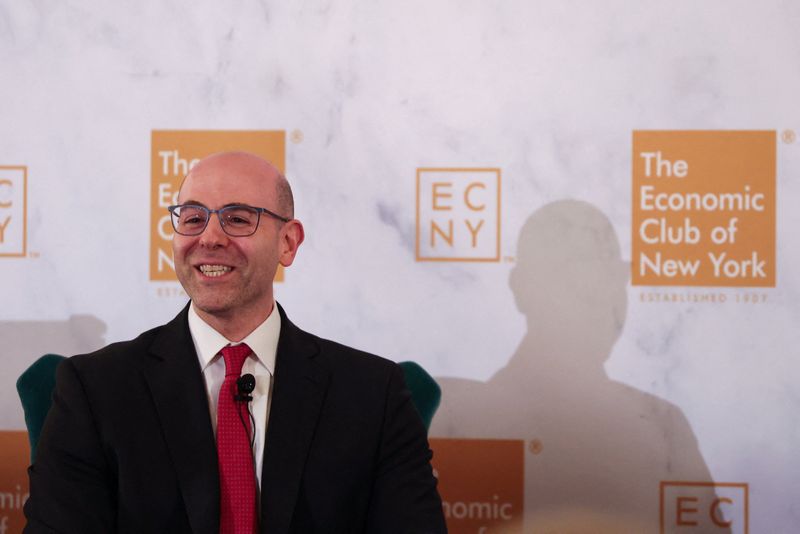

Kipp deVeer, co-President of Ares Management, shared insights on the booming AI data center market and the firm's investment strategies during a conversation with Lisa Abramowicz at the Greenwich Economic Forum. He highlighted the importance of providing clients with access to alternative investments while expressing concerns about potential inflation resurgence and the anticipated rate cuts from the Federal Reserve. This discussion is significant as it reflects the evolving landscape of investment in AI and the broader economic implications.

— Curated by the World Pulse Now AI Editorial System