Fed’s Bowman Says New Stress Test Proposals Coming Soon

PositiveFinancial Markets

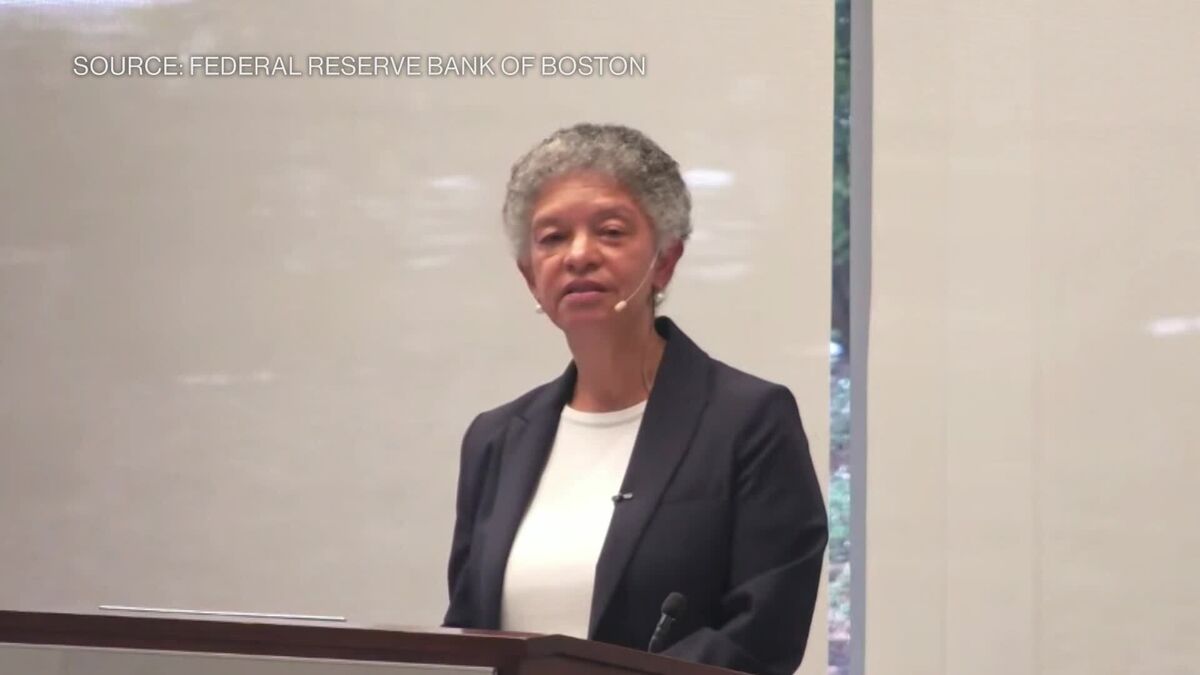

The Federal Reserve's top official, Michelle Bowman, has announced that new proposals for stress tests will be revealed soon, a development that is expected to be welcomed by Wall Street lenders. This is significant as it indicates a potential easing of regulatory pressures, which could enhance the financial stability and operational flexibility of banks.

— Curated by the World Pulse Now AI Editorial System