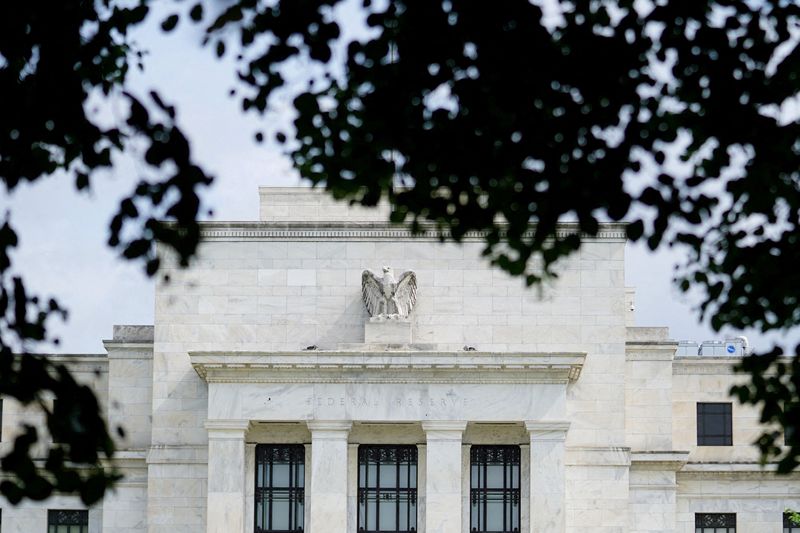

Indian Equities Could Ride Asian Markets Rally on Fed Rate Cut Hopes

PositiveFinancial Markets

Indian equities are poised to benefit from a potential rally in Asian markets, fueled by hopes of a Federal Reserve rate cut. This news is significant as it suggests a favorable environment for investors, potentially leading to increased market activity and confidence in the Indian economy.

— Curated by the World Pulse Now AI Editorial System