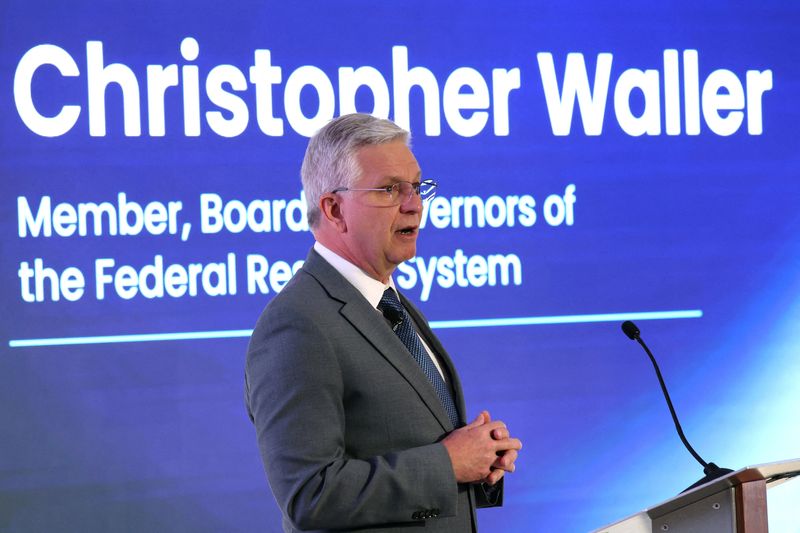

Fed’s Waller proposes ’skinny’ master accounts for payment innovators

PositiveFinancial Markets

In a recent proposal, Fed's Waller has introduced the idea of 'skinny' master accounts aimed at payment innovators. This initiative is significant as it could streamline access to banking services for new financial technologies, fostering innovation and competition in the payment sector. By simplifying the account structure, Waller's proposal may encourage more startups to enter the market, ultimately benefiting consumers with better services and lower costs.

— Curated by the World Pulse Now AI Editorial System