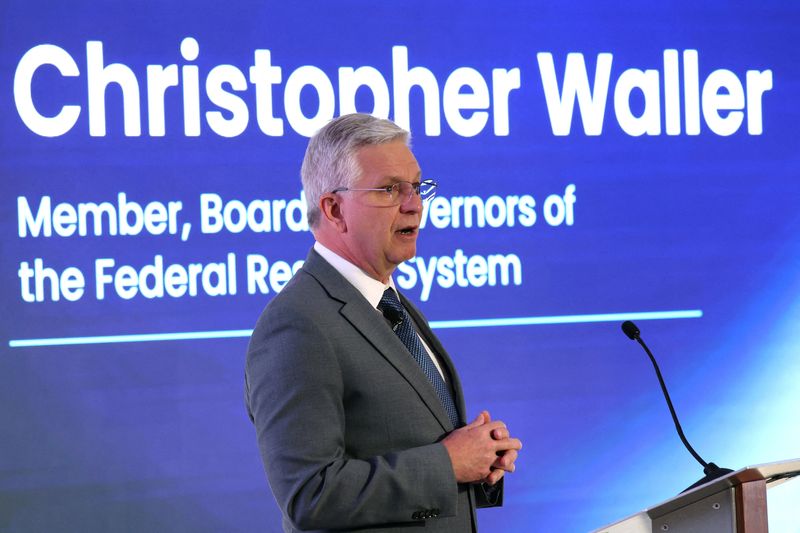

Waller says Fed staff studying streamlined 'payment accounts'

NeutralFinancial Markets

Federal Reserve official Christopher Waller announced that the Fed's staff is exploring the concept of streamlined payment accounts. This initiative could potentially simplify the payment process for consumers and businesses alike, making transactions more efficient. Understanding these developments is crucial as they may influence future monetary policy and the overall financial landscape.

— Curated by the World Pulse Now AI Editorial System