Oil heads for weekly gain on supply fears due to US sanctions on Russian companies

PositiveFinancial Markets

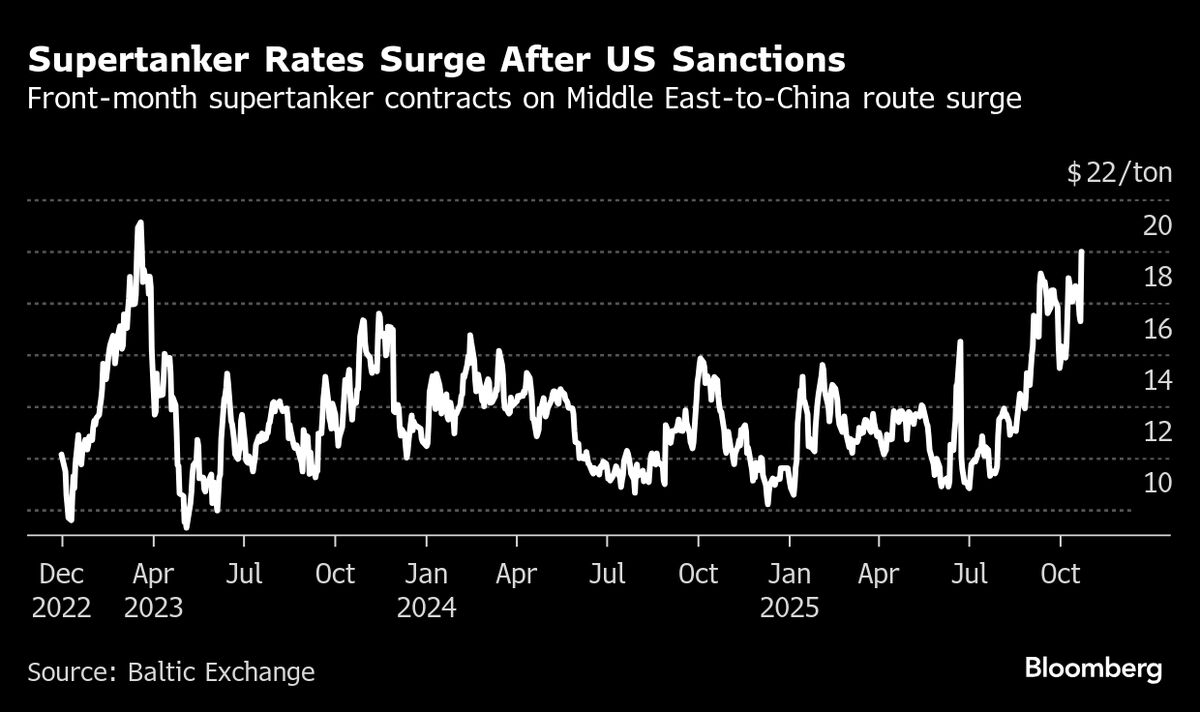

Oil prices are on track for a weekly gain as concerns about supply disruptions rise due to new US sanctions on Russian companies. This development is significant as it highlights the ongoing geopolitical tensions and their impact on global energy markets. Investors are closely monitoring these sanctions, which could lead to tighter oil supplies and potentially higher prices, affecting economies worldwide.

— Curated by the World Pulse Now AI Editorial System