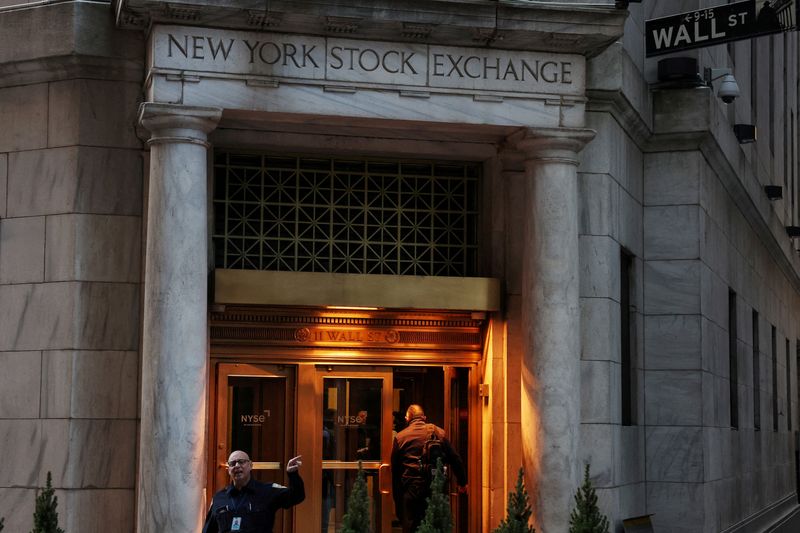

LiveOne receives Nasdaq delisting notice, appeals and enacts reverse stock split

NegativeFinancial Markets

LiveOne has received a delisting notice from Nasdaq, prompting the company to appeal the decision and implement a reverse stock split. This situation is significant as it highlights the challenges LiveOne faces in maintaining its listing status, which could impact investor confidence and the company's market position.

— Curated by the World Pulse Now AI Editorial System