Here’s What You Need to Know Before Hong Kong Stock Market Open

PositiveFinancial Markets

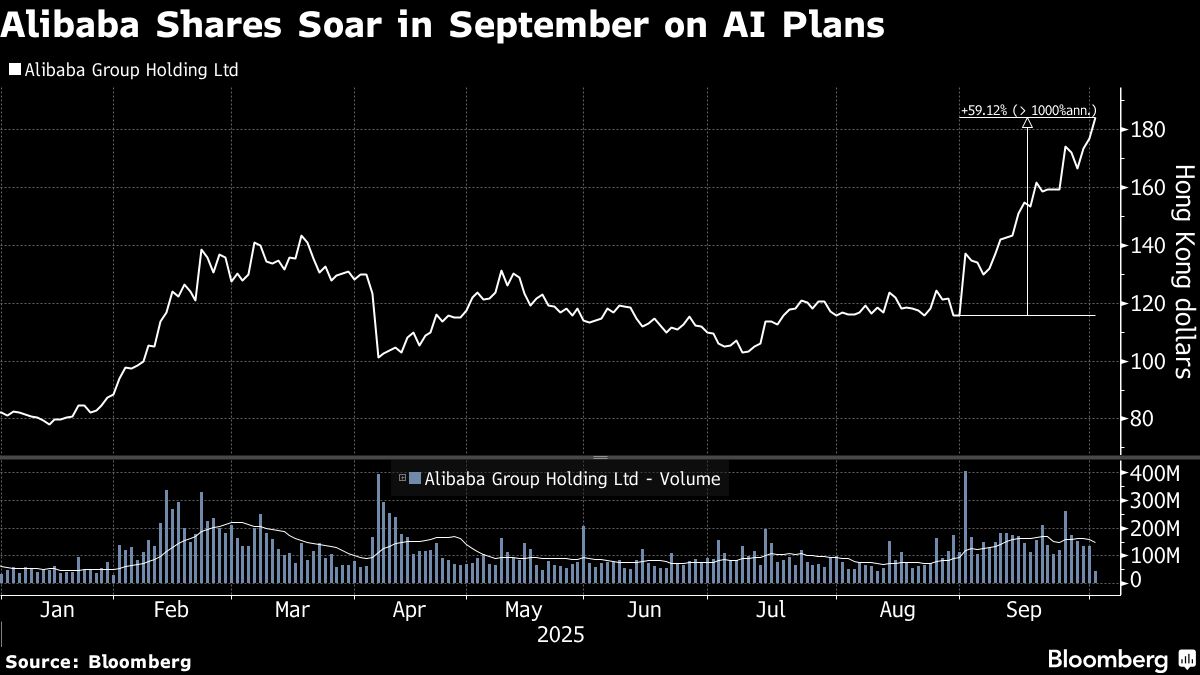

The Hong Kong stock market is set to open on a positive note, following a rise in the Nasdaq Golden Dragon China Index by 1.4% and a 0.3% increase in the S&P 500. This uptick is significant as it reflects growing investor confidence and could signal a favorable trading environment for stocks in Hong Kong, making it an important moment for traders and investors alike.

— Curated by the World Pulse Now AI Editorial System