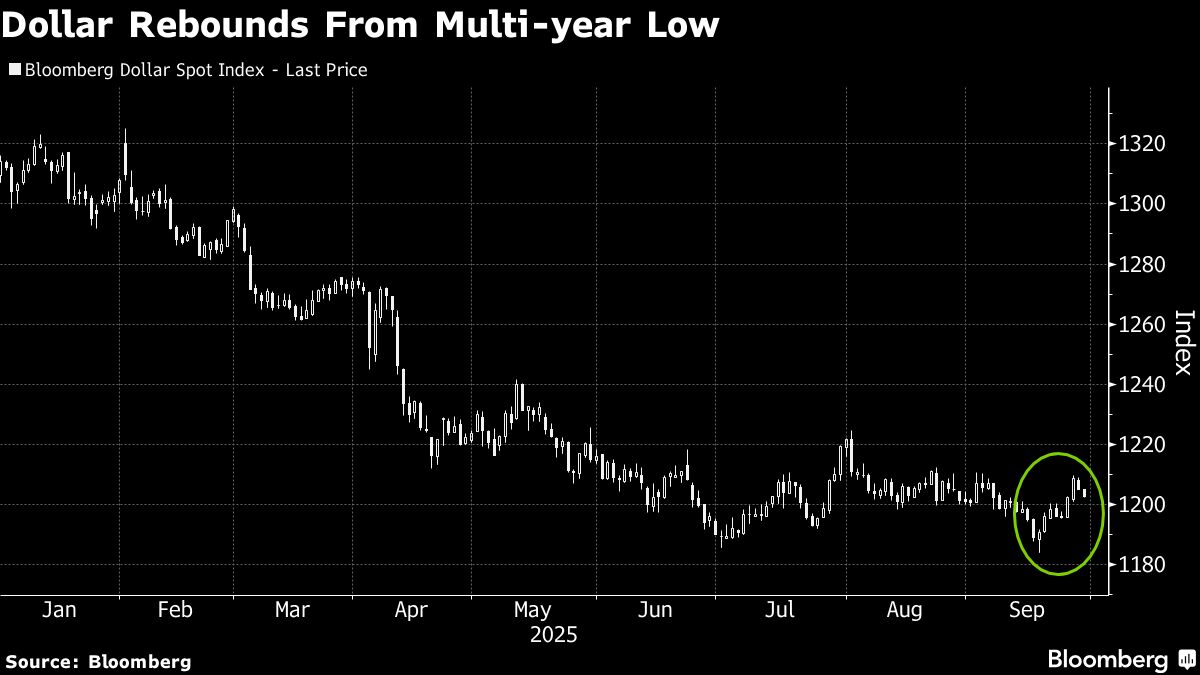

Gold prices hit record high near $3,800/oz on US shutdown risks, rate cut bets

PositiveFinancial Markets

Gold prices have surged to a record high of nearly $3,800 per ounce, driven by concerns over a potential US government shutdown and increasing bets on interest rate cuts. This spike in gold prices is significant as it reflects investor anxiety about economic stability and the value of traditional currencies. As uncertainty looms, gold is often seen as a safe haven, making this trend noteworthy for both investors and the broader economy.

— Curated by the World Pulse Now AI Editorial System