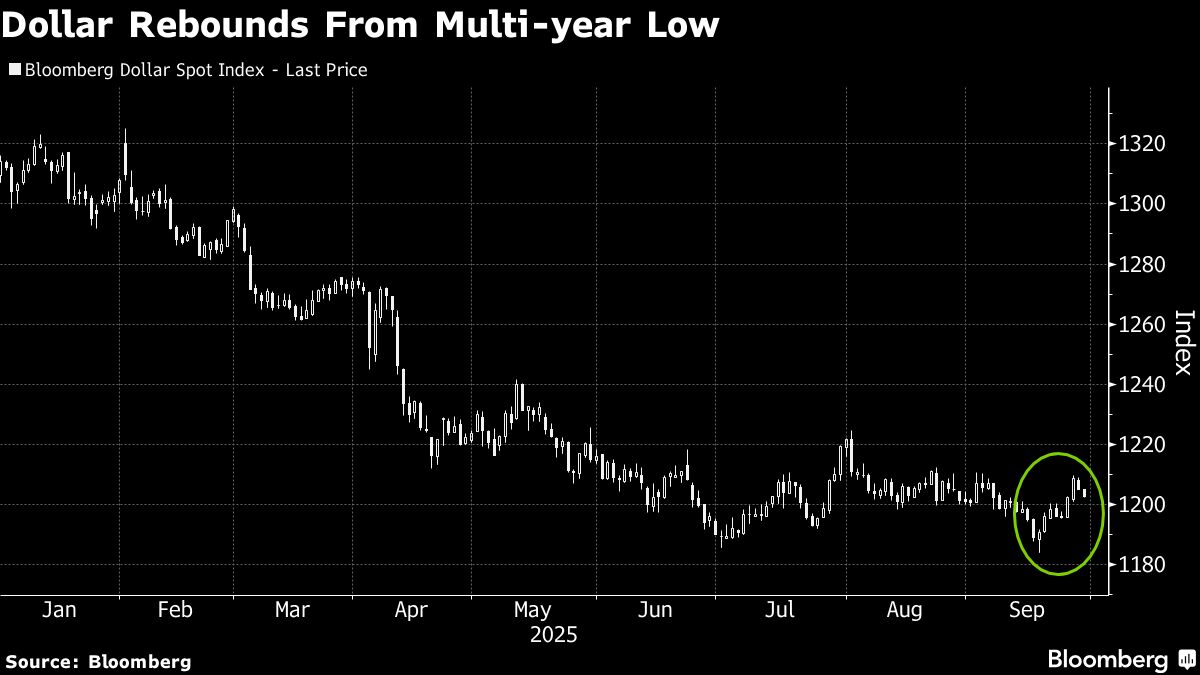

US Dollar Starts Event-Loaded Week on Back Foot as Shutdown Looms

NegativeFinancial Markets

The US dollar is facing a challenging start to a week filled with significant events, as it has begun to decline amidst concerns over a potential government shutdown. This situation is important because fluctuations in the dollar can impact global markets and economic stability, affecting everything from trade to consumer prices.

— Curated by the World Pulse Now AI Editorial System