Mixed share reaction to megacap earnings burst, Meta droops

NegativeFinancial Markets

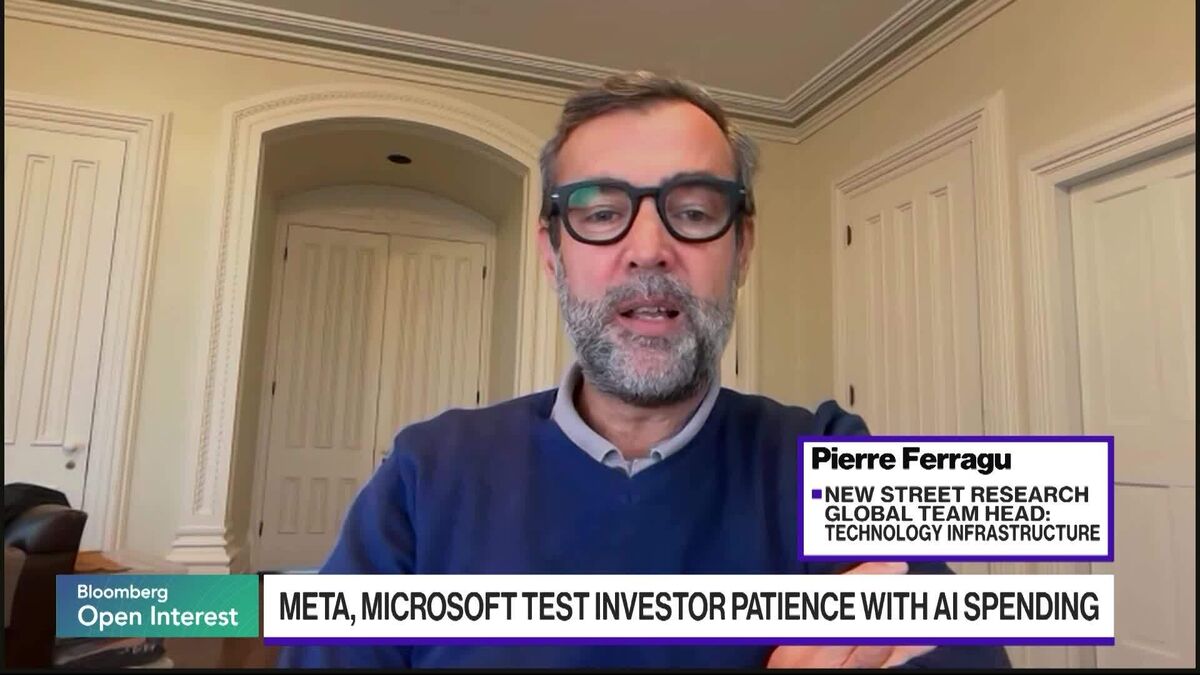

The recent earnings reports from major companies have led to a mixed reaction in the stock market, with Meta's shares experiencing a notable decline. This downturn is significant as it reflects investor concerns about the tech giant's future performance amidst a competitive landscape. Understanding these fluctuations is crucial for investors looking to navigate the current market dynamics.

— Curated by the World Pulse Now AI Editorial System