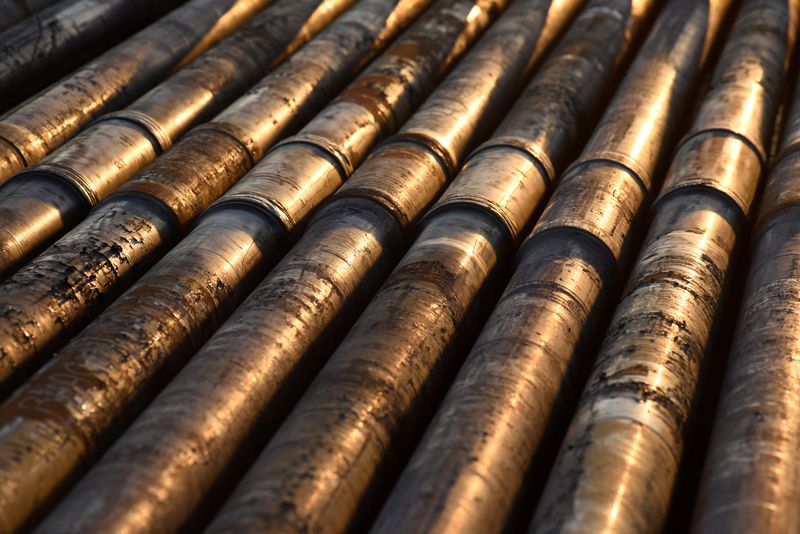

Pemex Says Its Hedges Made $150 Million as Oil Prices Fell

PositiveFinancial Markets

Pemex, Mexico's state-owned oil company, recently announced a gain of approximately $150 million from its crude oil hedges as oil prices declined last month. This is significant as it showcases Pemex's strategic financial management in a volatile market, helping to stabilize its revenue despite fluctuating oil prices.

— Curated by the World Pulse Now AI Editorial System