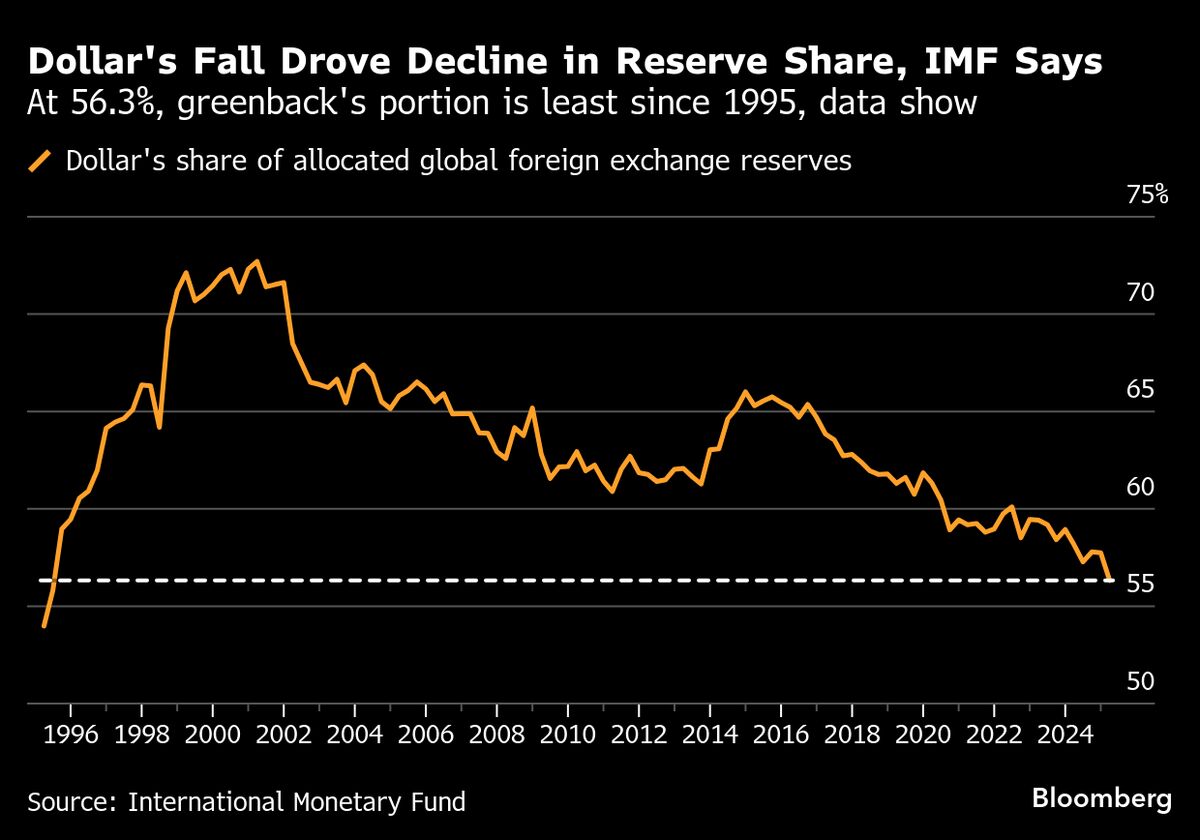

Dollar Slump Puts Share of Foreign Reserves at 30-Year Low

NegativeFinancial Markets

The share of dollars held by foreign central banks has fallen to its lowest level in 30 years, a significant shift that reflects a steep decline in the currency's value rather than a decrease in overall holdings. This matters because it indicates changing dynamics in global finance, potentially affecting international trade and investment strategies.

— Curated by the World Pulse Now AI Editorial System